Competency E1: Describe Project Management

Learning Task 2

Describe Records Management

Records management is the control and maintenance of both digital and hard copy documentation of transactions and business activity, also known as records. This includes the creation, identification, storage, retrieval, and disposition of such records. There are two categories of records management:

- Traditional physical paper documents: Paper records are often managed by an offsite record management firm or kept on premises in an office filing cabinet. Smaller organizations typically start by storing hard-copy documents in office spaces but as they grow, so does the number of records they need to track, which eventually leads to misplaced documents, slow processes, and confusion.

- Electronic files: Electronic files are digital information that can be created, stored, modified, archived, and distributed quickly by an electronic system. This includes text-based documents, digital images, audio files, emails, SMS (Short Message Service) messages, databases, and other electronic formats. Electronic records that contain personal information are protected through specific Canadian regulations such as the Personal Information Protection and Electronic Documents Act (PIPEDA) which in British Columbia exists as the Personal Information Protection Act (PIPA). This means sensitive and confidential data must be preserved, maintained, and destroyed in compliance with these regulations.

Paper records are stored in physical boxes or file cabinets on premises or at a storage facility. Electronic records are stored on storage media in-house, off site or in the cloud. Paper-based filing today is considered by many to be low-tech and only advantageous for small companies where a limited number of people need infrequent access to records, and where an audit by an outside agency would be easily facilitated. The advantages to electronic filing over paper filing are numerous and include:

- Minimal physical storage space required

- Accessibility by numerous parties from remote locations

- Security controls ensure sensitive documents are not compromised

- Protection from physical loss and damage (fires, floods, etc.)

- Ability to update easily and quickly while still retaining original copies

- Unlimited portability, able to be transmitted instantly across the globe

- Document finding is quick and easy through key search words

- Time-related reminders can be inserted, preventing missed deadlines

- Organizable by selectable parameters such as date, topic, department, etc.

- Ability to copy and paste to save in multiple files and folders

- Satisfies the “green” move to a more paperless world

There are numerous companies that offer records management software that can be tailored to a company’s specific requirements. The following are headings and descriptions that are likely to form the basis for a subcontractor’s records management system, regardless of the company’s size or being paper/paperless.

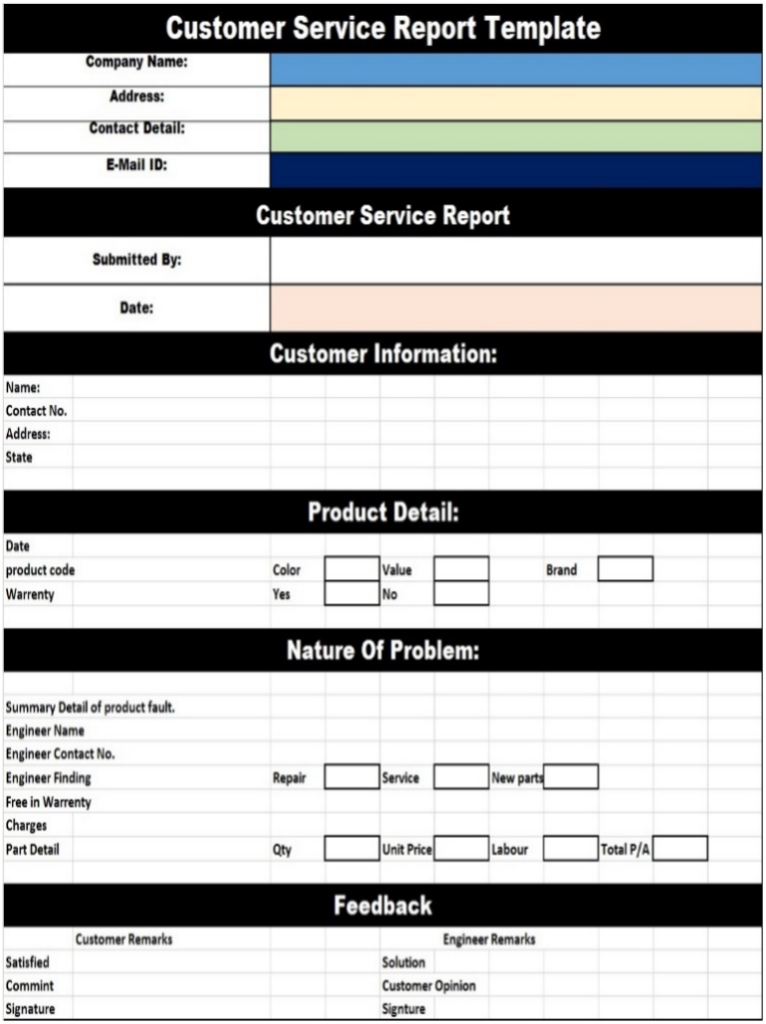

Service Reports

Service reports are typically used by supervisors to track employee productivity and ensure that quality standards are being met. When writing a customer service report, it is important to include all pertinent information about the interaction. This includes the date, time, name of customer service representative, and any other relevant details. It is also important to be clear and concise in writing the report. An example template for a service report is shown below.

The Field Service Report is an important document used by field service technicians to create detailed reports upon completion of a service call. It generally includes several key components, including customer and service details, a list of services performed, any materials used, time spent, and can also include customer feedback if desired.

Invoices

An invoice is a time-stamped commercial document that itemizes and records a transaction between a buyer and a seller. Most service companies will establish the terms of payment they will require prior to showing up at the site, and an invoice will be created, or a bill of sale will be paid upon completion of the job. If goods or services were purchased on pre-established credit, the invoice usually specifies the terms of the deal and provides information on the available payment methods. If not quoted as a lump sum fee, which is known as “flat rate pricing”, invoices will be broken down to show parts used and their cost, as well as time spent for the labour involved along with a cost-per-hour. As well, travel time either one-way only or both ways between the contractor’s shop and the jobsite is commonly a billable expense but this should be established with the customer before agreeing to take on the work. Types of invoices may include a paper receipt, a bill of sale, a debit note, a sales invoice, or an online electronic record.

Time Sheets

A timesheet is a data table which an employer can use to track the time a particular employee has worked during a certain period. Businesses use timesheets to record time spent on tasks, projects, or clients for billing purposes, and are mainly associated with recording a worker’s time for payroll purposes. They are also a valuable tool in management accounting, as they help managers to record start and end times for tasks and help identify the amount of time needed for each type of work done by the company. This is handy when managers need to know which tasks can take up more time and identify areas that may delay completion of work. There are different methods that have been used to record timesheets, such as paper, spreadsheet software, and online time-tracking software.

Purchase Orders

Purchase orders are the documents through which a company will order goods from their suppliers, usually through a pre-established credit account. Purchase orders are sent by the buyer to the vendor first, and they outline exactly what the order should contain and when it should arrive. It will include things like quantity of items, detailed descriptions of the items, the price, date of purchase, and payment terms. A vendor sends an invoice for the order only after they have approved the purchase. When invoicing, vendors usually include the purchase order number (PO number) included on the original purchase order, so that the company’s financial department can make sure the information on both forms is the same. Many companies insist that their employees must provide a P.O. number for any supplier that they are requesting goods from, to ensure control over unnecessary or unauthorized purchases, and may include the requirement for the vendor to check with the company before authorizing any purchase on a purchase order.

Vehicle Logs

The best evidence to support the use of a vehicle for business purposes is an accurate logbook of business travel maintained for the entire year, showing for each business trip the date, destination, the reason for the trip and the distance covered. Establishing vehicle use is critical for taxation purposes, as any non-business use is considered an employee perk and may be taxable to the individual. The Canada Revenue Agency have a simplified version of a logbook that can kick in after one full year of keeping a detailed log of vehicle use. The odometer readings from vehicle mileage logs are also used to establish maintenance schedules for company vehicles.

Maintenance Logs

A maintenance log is simply a record of work that was performed on an asset, either portable or stationary, for the purposes of prescribing routine maintenance on it or, if it failed, to determine if its failure may have been premature or predictable. The process is simple, in that work gets done and a log gets updated. However, logs are only beneficial if they are routinely consulted, and digital records management can provide reminders for the checking of maintenance logs.

Inventory

Inventory refers to any raw materials and finished goods that companies have on hand for production purposes or that are sold on the market to consumers. Two types of inventories are periodic and perpetual inventory, and both are accounting methods that businesses use to track the number of products they have available. Periodic inventory is one that involves a physical count at various periods of time (annually at a minimum) while perpetual inventory is computerized, using point-of-sale and an asset management system. The periodic inventory system is often used by smaller businesses that have easy-to-manage inventory and may not have a lot of money or the opportunity to implement computerized systems into their workflow. As such, they use occasional physical counts to measure their inventory and the cost of goods sold to establish profit margins. Perpetual inventory systems are much more sophisticated and expensive to put in place. Products are given barcodes, which keep track of their movement, such as how long they’ve been on the shelf. Perpetual inventory systems allow vendors to cut back on stocking products that aren’t big sellers while ramping up inventory on those that are. Computer software manages the tracking, updating, and restocking of the products through the point-of-sale system.

Permits

Permits are documents that help ensure that construction and major renovations comply with local bylaws, codes, and health/safety standards. If a permit is required, it must be obtained before any stage of a project can start, and there can be heavy fines and “Stop Work Orders” involved if required permits aren’t purchased or adhered to. Depending on geographical location, the necessity and process for obtaining a permit can vary. Examples of local jurisdiction permits are for building, demolition, and building occupancy. Gas, electrical, and septic system installations are examples of permits that are usually obtained through a provincial agency such as Technical Safety BC (TSBC) although some cities within British Columbia have agreements with TSBC that allow local permits and inspections of gas and electrical work. Digital records management systems can track the status of all permits and issue notifications if a permit is about to expire or can be closed on the completion of a job.

Statements of Completion

In construction, there are two phases or statements of completion of a project: substantial and final.

Substantial completion refers to a point in time when the building can be used for its intended purpose, even if it is not considered totally complete. In construction, substantial completion is a legal term often used in contracts between project owners and contractors, and it marks the point when the project is considered complete except for remaining minor, corrective, or warranty work. Typically, substantial completion marks the point of the project when the owner is responsible for paying the contractor or subcontractors the remainder of their fees. The owner may also now be responsible for the payment of all utilities from that point.

Final completion indicates that all work has been fully finished, including the resolution of any outstanding issues or deficiencies. While substantial completion triggers certain financial and legal events, such as partial payment and the start of warranty periods, final completion marks the conclusive end of the project, releasing the remaining retainage (holdbacks) and initiating the final payment. It is the point at which the contractor’s responsibilities are fulfilled entirely. Both levels of completion involve the signing of documents (statements) by both the owner or their representative and the project manager and subcontractors. On commercial jobsites, there is normally a site inspector, also known as the “Clerk-of-Works”, who represents the owner and whose responsibility it is to determine that the general contractor and all the subcontractors have carried out all aspects of contractual work before they can be given a Statement of Completion.

Now complete Self-Test 2 and check your answers.

Now complete Self-Test 2 and check your answers.

Self-Test 2

Self-Test 2

Media Attributions

- Figure 1. “Service report” from Free Report Templates is used for educational purposes under the basis of fair dealing.