4 Blockchain & Cryptocurrency

Blockchain is a record keeping technology that can be used to record information about any number of things such as: voting records, supply chains and item histories, medical data, and perhaps is best known as the technology behind cryptocurrency.

Let’s compare a cryptocurrency transaction to traditional electronic transfer of funds. Assume Person 1 wants to send Person 2 some money.

| Traditional eTransfer | Cryptocurrency Transfer | |

|---|---|---|

| Who knows about the transfer? | Person 1 and their bank.

Person 2 and their bank. |

Person 1 and Person 2 and the cryptocurrency (e.g. bitcoin) “blockchain”. |

| Are the true identities of Person 1 and 2 known? | Yes, by the banks involved. | Not necessarily, they could be anonymous. |

| Who keeps the records of the transaction? | The banks involved. | The “blockchain”. |

| Are these records private or public? | Private | Public (certain details). |

| Are there fees to transfer the funds? | Sometimes there are bank fees, especially for international transactions. | Yes, fees vary, but are roughly comparable to traditional bank fees. |

| How fast does the transfer happen? | Within your home country the transfer is usually fast; however, if crossing international borders the transfer usually takes a number of days. | Currently, averaging 30-60 minutes regardless of whether the transaction is domestic or international. In some cases, transactions can take days. |

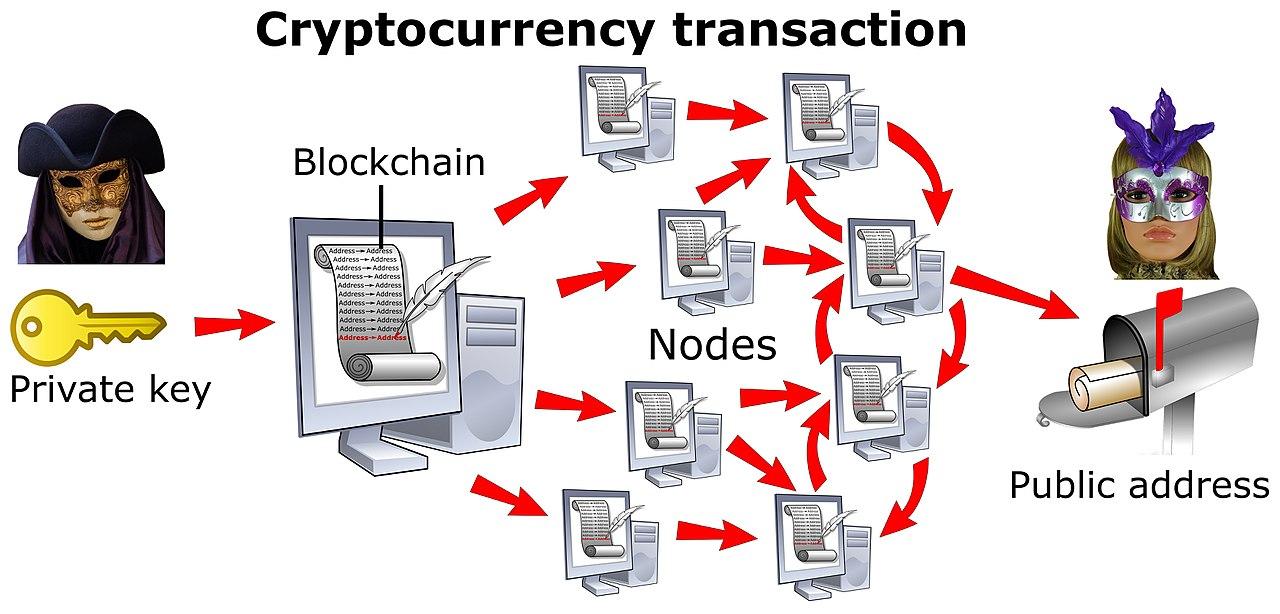

In blockchain, the records are referred to as blocks, and the blocks are chained (or linked) together using cryptographic methods which are designed to ensure the record keeping is secure, verifiable and permanent. Additionally, the record keeping is decentralized and distributed across a number of different computer systems (nodes) to achieve these goals.

Each transaction has a “private” and “public” component to it. In broad terms, comparing this to a traditional bank transaction, the “private” portion would be like your banking password, and the public portion would be an email address. You keep your password “private” (so others can’t access your account), but you can give out your “public” email address so that people can send you money.

Cryptocurrency is digital money, which means there’s no physical coin or bill – it’s all online. Bitcoin is one of the best known cryptocurrencies, but there are many others, and new cryptocurrencies (or coins) are being created regularly.

One of the big advantages of a cryptocurrency is you can transfer it to someone online without a go-between (such as a bank), so it can be a much faster (potentially instantaneous) transaction.

Issues with Cryptocurrencies

Unfortunately, cryptocurrencies such as Bitcoin are still in their infancy and have some substantial issues facing them:

Reputation

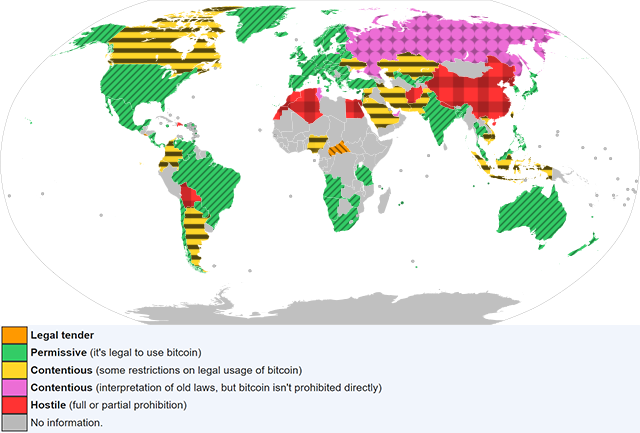

Due to the fact Bitcoin transactions provide a level of anonymity for the buyer and seller, it is a popular choice for illegal activity (money laundering, purchase and sale of illegal drugs, ransomware, etc.). Possession or trading in Bitcoin is currently illegal in a number of countries throughout the world, and it is too early to tell if this trend will continue, or reverse itself.

Non Fiat

A fiat currency is legal tender in the country of issue (i.e. it can be used anywhere in the country to make purchases, pay bills, etc.), and is overseen by a central bank – Bitcoin is currently only a fiat currency in two countries – El Salvador and Central Africa Republic. Although some businesses are willing to accept Bitcoin, it is not yet widely accepted, and businesses where it can be spent are still limited.

Lack of Transparency/Regulatory Oversight

In many ways cryptocurrency more closely resembles stocks than currency (as its value can be subject to large price variations day-to-day). In contrast to most stock markets, where major shareholders in a public company are known, and regulations exist to penalize anyone who would attempt to manipulate the price of stock, use of Bitcoin often lacks these protections. The person (or persons) rumored to have the largest Bitcoin holding goes by the name of Satoshi Nakamoto (credited as the initial developer(s) of Bitcoin), but their true identity remains unknown.

Volatility

Bitcoin has seen some wild price swings, both up and down, for example the value of one bitcoin on the following dates was:

- April 14, 2021 – $63,001 USD

- April 24, 2021 – $49,706 USD

- July 19, 2021 – $29,619 USD

- October 8, 2021 – $53,811 USD

Note: Even though the price of one bitcoin is substantial, each bitcoin is made up of 100,000,000 satoshis (the smallest units of bitcoin), which allows people to purchase fractions of a bitcoin with as little as one U.S. dollar.

Environmental Impact

The process of creating Bitcoin transactions is referred to as “mining”, and these mining processes require substantial computing power (and the associated electricity to run the computers). Companies engaged in Bitcoin mining often locate their server farms (many computers working in unison) in colder remote communities where electricity is less expensive, as the server farms consume substantial amounts of electricity, and need colder temperatures to dissipate the substantial amounts of heat they generate with their computers. Data from the University of Cambridge’s Bitcoin Electricity Consumption Index shows that the Bitcoin network now consumes more electricity than many countries. If Bitcoin was a country, it would be the 34th largest consumer of electricity on the planet in October 2021, putting its annual electricity consumption ahead of countries such as Finland.

Cryptocurrency FAQ (Frequently Asked Questions)

- Are cryptocurrency transactions secret?

- No, the details of the account that has the “coin”, who had it before, etc. are recorded. What is not recorded (or easily accessed) is who owns the accounts.

- How do you buy and sell cryptocurrency?

- Most people rely on crypto exchange services like Coinbase, Robinhood, and recently PayPal (although the crypto in a PayPal account cannot be transferred to other accounts on or off the platform).

- Where do I store my cryptocurrency?

- Crypto is digital, so in a similar way that digital photos are stored on a computing device, cryptocurrency is also stored on a computing device. Examples of storage locations include: a personal computer, a detachable hard drive, cloud storage, etc. The storage location is typically referred to as a digital “wallet”.

- What is the difference between a “hot wallet” and a “cold wallet”?

- A hot wallet is connected to the internet, a cold wallet is not. A hot wallet makes it easier to trade or spend crypto, but it could be vulnerable to online attacks and theft. A cold wallet is typically not connected to the internet, so while it may be more secure, it’s less convenient.

- What happens when Bitcoins are lost?

- If you lose your private keys, unfortunately, there is no back-up or secret back door to retrieve your funds. It is crucial to write down and keep safe all your passwords and seed phrases for your exchange wallets and hard wallets. Some estimates predict there has been over 5 million Bitcoin lost since it’s creation, with no way of getting them back.

- Has a crypto exchange ever been hacked?

- Mt. Gox, once the dominant bitcoin exchange, was the first high-profile hack in cryptocurrency history. The hack forced the exchange to file for bankruptcy, as it lost 750,000 of its users’ bitcoins, plus 100,000 of its own.

Image Descriptions

Figure 4.2 Legality of bitcoin by country or territory image description:

A world map demonstrating the legal status of Bitcoin in different regions. It shows where Bitcoin is legal tender, permissive (it’s legal to use Bitcoin), contentious (some restrictions on legal usage of Bitcoin), contentious (interpretation of old laws, but Bitcoin isn’t prohibited directly), hostile (full or partial prohibition), and no information. Overall, the map shows that Bitcoin can be used in many countries (although some countries impose restrictions). However, there are a number of countries where the use of bitcoin is prohibited. The following list provides an in-depth description:

- Legal tender (marked in orange colour and backslashes): Central Africa Republic, El Salvador.

- Permissive (it’s legal to use Bitcoin, marked in green colour and forward slashes): most of Europe and Oceania, some regions in the Americas (e.g. USA, Mexico, Chile, Brazil etc.), Africa (e.g. South Africa, Angola, Namibia, Tanzania, and Zimbabwe), and Asia (e.g. South Korea, Japan, Thailand, Malaysia, India, Turkey etc.)

- Contentious (some restrictions on legal usage of Bitcoin, marked in yellow colour and horizontal strips): Canada, Argentina, Columbia, Ecuador, Nigeria, Ukraine and some regions in Asia (Kazakhstan, Saudi Arabia, Syria, Iran, Taiwan, Indonesia etc.)

- Contentious (interpretation of old laws, but Bitcoin isn’t prohibited directly, marked in pink colour and diamonds): Russia, Tunisia, United Arab Emirates.

- Hostile (full or partial prohibition, marked by read colour and squares): China, Nepal, Afghanistan, Egypt, Morocco, Algeria, Western Sahara, Dominican Republic and Bolivia.

- No information (marked by grey colour): majority of central Africa and Madagascar, some regions in central and south America (Peru, Cuba Uruguay, Guatemala etc.), Asia (Mongolia, Iraq, Sri Lanka, Turkmenistan etc.), and a few regions in Europe (Serbia, Kosovo, Montenegro, and Moldova).

Figure 4.3 Bitcoin (BTC) trading price on Nasdaq image description:

Bitcoin trading price swing from 2019 to 2021:

- 2019: price swing around 10k in the second half of the year

- 2020: price swing under 10k in the first half of the year, then price swing above 10k and reaching 30k by the end of the year

- 2021: price swing from 30k to above 60k in the first half of the year, price swing between 30k and 50k in the second half of the year.

Media Attributions

- “Cryptocurrency transaction” by Mikael Häggström is licensed under a CC0 1.0 Universal licence.

- Figure 4.2 Legality of bitcoin by country or territory is adapted from “Legal status of bitcoin” by Manabimasu is licensed under a CC0 1.0 Universal licence.

- Screen capture from Bitcoin Latest Prices, Charts & Data | Nasdaq October 9, 2021.