Employment Standards for B.C. Food Service Workers

11 Wages and Wage Statements

The minimum wage in British Columbia applies to all workers, no matter what their age. The minimum wage is changed from time to time to reflect changes in the cost of living.

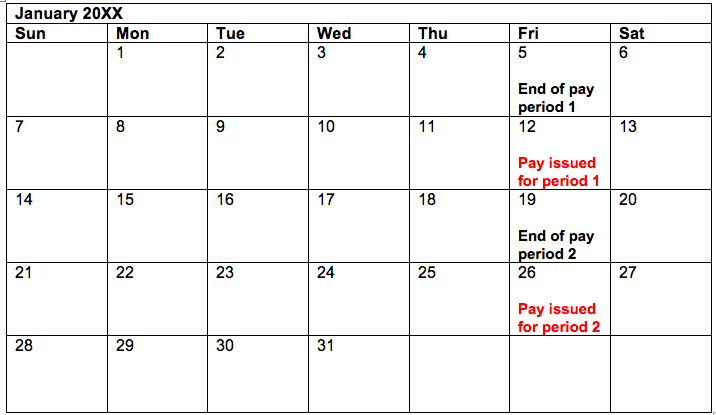

Employees must be paid at least twice a month. All money earned in a pay period must be paid within eight days after the end of the pay period. This does not include annual vacation pay and wages credited to an employee’s time bank. A pay period cannot exceed 16 days in length. For example, if a food server works the month of January, and the pay period is from January 6 to January 19, the server must be paid by January 27 (Figure 4). Wages can be paid by cash, cheque, direct bank deposit, bank draft, or money order. Payment by direct bank deposit must be authorized in writing by the employee or by a collective agreement.

Employers cannot make deductions from the employees’ wages without the written consent of the employee unless the deductions are permitted or required under provincial or federal law. For example, employers are required by federal law to deduct employee contributions for income tax, Canada Pension, and Employment Insurance.

Employees may request that the employer pay part of his or her wages to a third party. This is called assignment of wages. An employer must pay assigned wages to:

- A trade union under the Labour Relations Act

- A charitable or other organization

- A pension or superannuation plan

- An insurance company for medical or dental coverage

- A person to whom the employee is required to pay maintenance under the Family Maintenance Enforcement Act

Employers must also honour an assignment of wages authorized by a collective agreement. For example, many collective agreements include a group life insurance plan as a benefit. If the collective agreement calls for this, employers must deduct the premium from the employees’ wages. Employers may honour a written assignment by an employee to pay a debt, but they are not obliged to do so. Any wages assigned by an employee must be paid within one month of being deducted.

Employees wishing to cancel an assignment of wages or cancel the direct deposit of their wages must notify the employer and the person or organization receiving the money in writing.

Employers may not deduct wages as a result of damage, breakage, or loss. For example, a restaurant is not permitted to charge an employee for breakage of glassware or dishes.

An employee who has been fired or laid off must be paid in full within 48 hours. If an employee resigns or quits, he or she must be paid in full within six days. If the employee cannot be located, the employer must pay the wages to the Branch within 60 days. The funds are then held in trust for the former employee.

Wage Statements

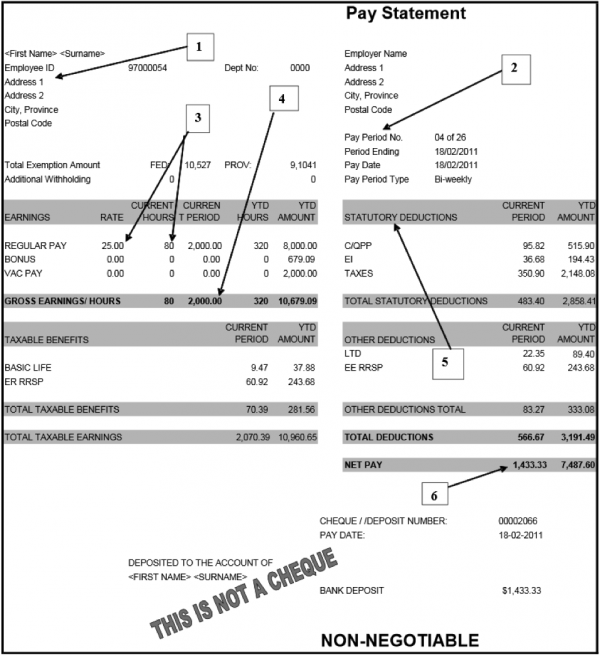

On each payday, the employer must give employees a written wage statement (Figure 5) that includes:

- The employee’s name and address

- The hours worked by the employee

- The employee’s wage rate

- The overtime wage rate

- The hours worked at the overtime rate

- Any other payment to which the employee is entitled (e.g., a bonus)

- The amount and purpose of all deductions

- A statement of how the wages were calculated if the employee is paid other than by the hour or by salary

- A statement of the employee’s net and gross wages

- Any amounts withdrawn from the employee’s time bank and how much remains

Legend for Figure 5:

- Employee information

- Pay period information

- Hours worked and rates of pay

- Gross earnings

- Statutory deductions

- Net pay

Once an employer has been issued a wage statement, a new statement is not required if the information has not changed from the previous statement. For example, if a cook worked exactly the same number of hours as in the previous pay period, and the rates and deductions were unchanged, a statement is not required.

In practice, most employers will issue a wage statement with each and every payment. Often this includes additional information such as the employee number, gross wages for the year to date, total deductions for the year to date, and the amount of any taxable benefits received.

You should keep the wage statements you have been issued. They are useful in case there is a dispute about the amount you have earned in a year. They can also be used to establish that you have been employed and the amount you have earned if you are not issued a T-4 statement of earnings for income tax purposes, or a record of employment for employment insurance purposes, or if you need proof of income for any reason, such as applying for a mortgage or loan.

Payroll Records

Employers are required to keep detailed payroll records at their principal place of business in the province. These records must be kept in English. The information in the payroll records must include:

- Employee’s name, date of birth, occupation, telephone number, and residential address

- The date on which the employee began employment with that employer

- The employee’s wage rate

- The hours worked on each day

- The benefits paid to the employee

- The employee’s gross and net wages for each pay period

- The amount of and reason for each deduction from the employee’s pay

- The dates of statutory holidays taken by the employee and the amounts paid

- The dates of annual vacation taken, the amounts paid, and the days and amounts owing

- The dates and amounts paid from the employee’s time bank, and the balance remaining

As you can see, a considerable amount of information must be kept. This information must be collected at the workplace and entered into the payroll records. Some employers use an automated time clock which the employees use to “punch in” the time at which they began work. They also “punch out” to record the time at which they complete their work. The completed time cards are collected by the employer and used to calculate the hours of work. Other companies use a time sheet on which the employee records his or her hours. Typically, this sheet is signed by the supervisor before being used to calculate pay.

No matter what system is used in your workplace, you must ensure that you record the hours you work so that your pay records are complete and accurate. It is also useful to keep a brief log of your work hours on a daily basis in case there is an error in the time records or a dispute between you and your employer about the number of hours worked.

Payroll records must be kept for seven years after employment ends.

Long Descriptions

Figure 5 long description: Sample pay statement. At the top left is the employee name, ID, and address. On the right there is the pay period number, payroll ending date, pay date, and pay period type. The pay statement shows the regular pay rate, the current hours, and the gross earning hours. It also shows statutory deductions and net pay in the current period. [Return to Figure 5]

Media Attributions

- Pay Period Schedule © BC Cook Articulation Committee is licensed under a CC BY (Attribution) license

- Sample Payroll Statement © Canadian Payroll Association. Used with permission

A period of up to 16 consecutive days of employment.

A) salaries, commissions or money, paid or payable by an employer to an employee for work.

B) money that is paid or payable by an employer as an incentive and relates to hours of work, production, or efficiency.

Does not include gratuities, money that is paid at the discretion of the employer and is not related to hours of work, production or efficiency, allowances or expenses, penalties, and administrative fees.

An organization of employees formed for purposes that include the regulation of relations between employees and employers.

A record of hours of work and pay required under the Employment Standards Act to be kept by an employer.