Chapter 7: Competing in International Markets

Drivers of Success and Failure When Competing in International Markets

Learning Objectives

- Explain the elements of the “diamond model.”

- Understand how the model helps to explain success and failure in international markets.

The title of a book written by newspaper columnist Thomas Friedman attracted a great deal of attention when the book was released in 2005. In The World Is Flat: A Brief History of the 21st Century, Friedman argued that the Internet coupled with globalization and increased liberalization of trade is leveling the competitive playing field between developed and emerging countries. This means that companies exist in a “flat world” because economies across the globe are converging on a single integrated global system (Friedman, 2005). For executives, a key implication is that a firm’s being based in a particular country is ceasing to be an advantage or disadvantage, except for industries where transportation is a key aspect of the product.

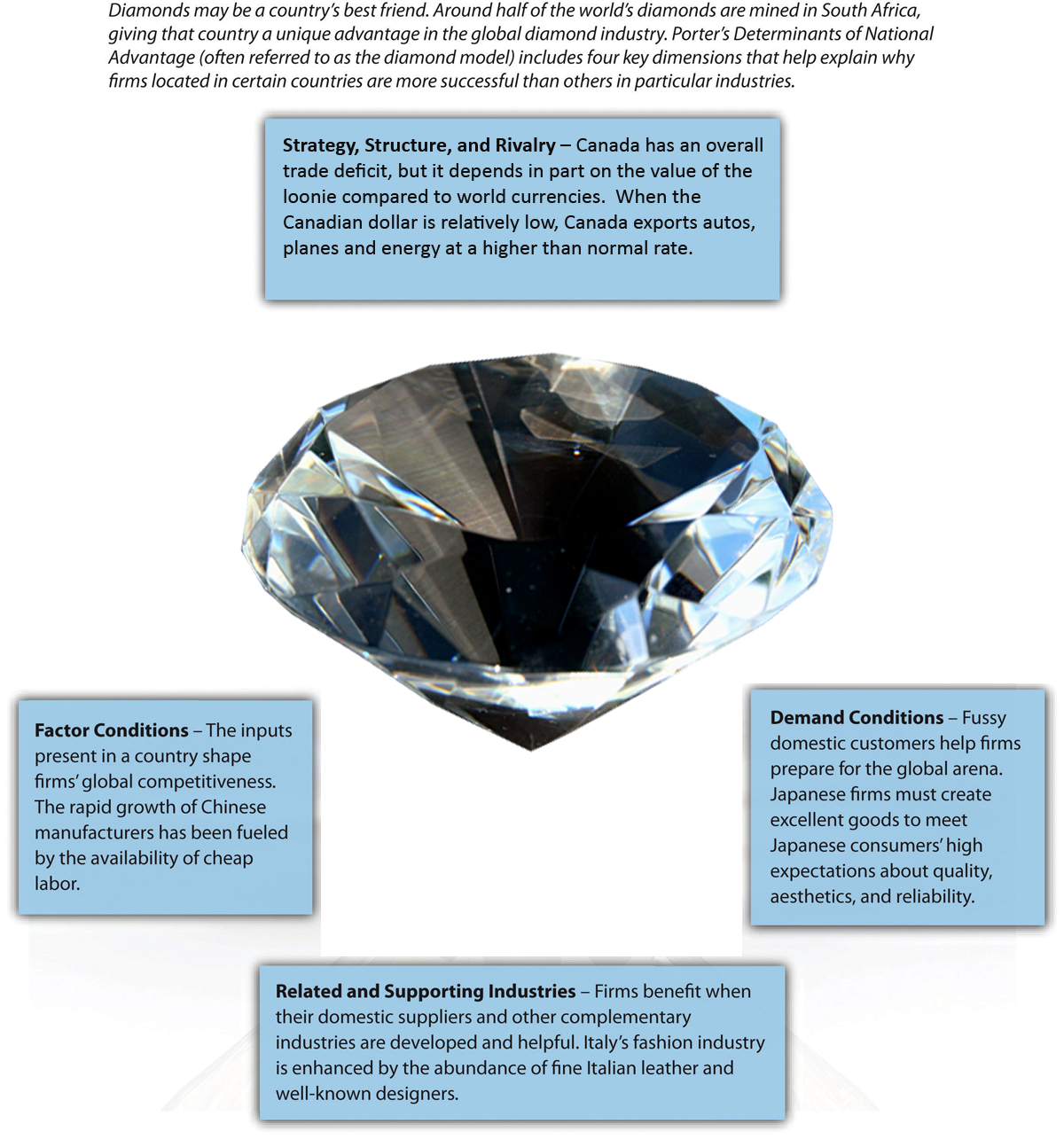

While Friedman’s notion of business becoming a flat world is flashy and attention grabbing, it does not match reality. Research studies conducted since 2005 have found that some firms enjoy advantages based on their country of origin while others suffer disadvantages. A powerful framework for understanding how likely it is that firms based in a particular country will be successful when competing in international markets was provided by Professor Michael Porter of the Harvard Business School (Porter, 1990). The framework is formally known as “the determinants of national advantage,” but it is often referred to more simply as “the diamond model” because of its shape (Figure 7.14 “Diamond Model of National Advantage”).

According to the model, the ability of the firms in an industry whose origin is in a particular country (e.g., South Korean automakers or Italian shoemakers) to be successful in the international arena is shaped by four factors: (1) their home country’s demand conditions, (2) their home country’s factor conditions, (3) related and supporting industries within their home country, and (4) strategy, structure, and rivalry among their domestic competitors.

Demand Conditions

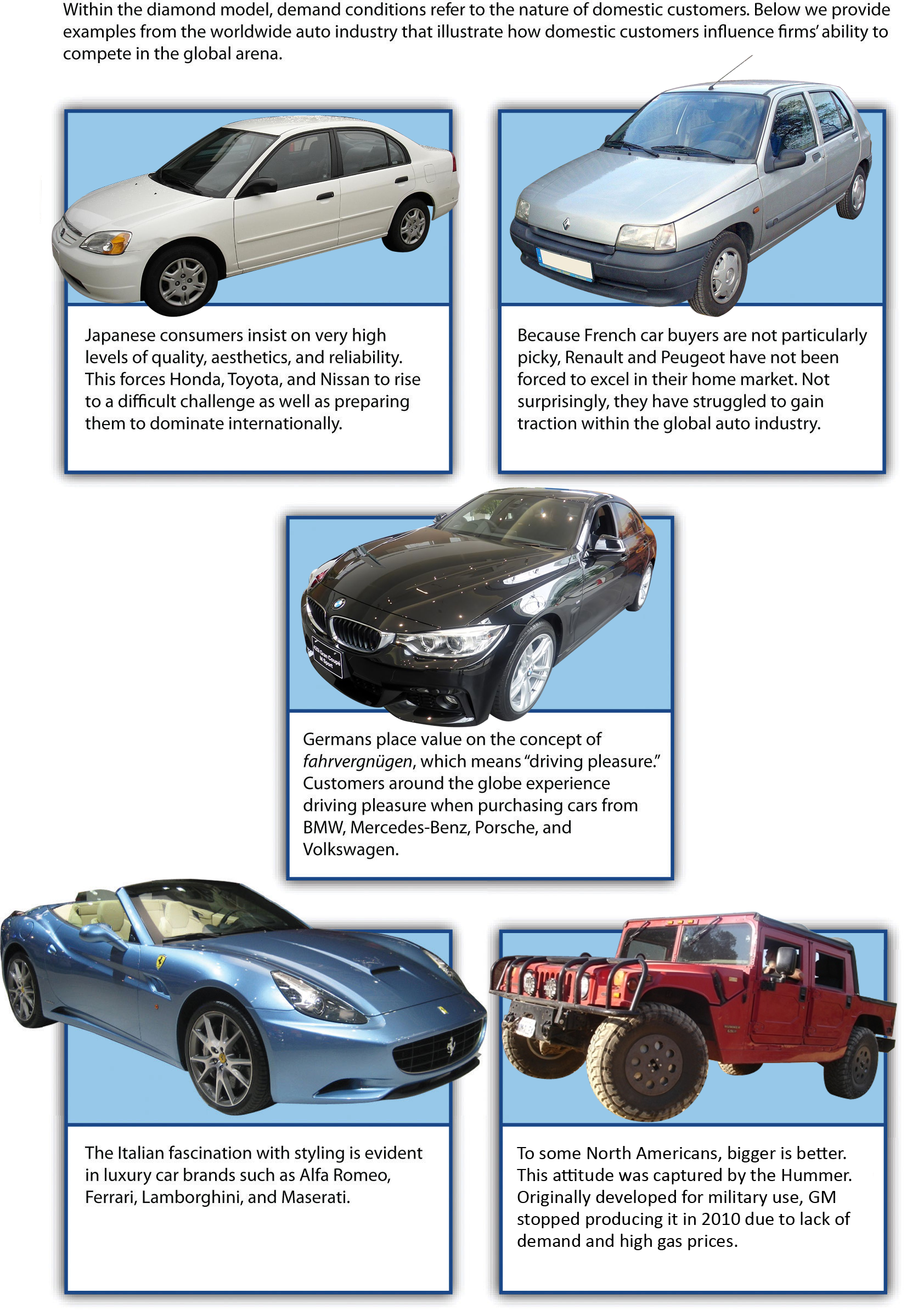

Within the diamond model, demand conditions refer to the nature and volume of domestic customers (Figure 7.15 “Demand Conditions”). It is tempting to believe that firms benefit when their domestic customers are perfectly willing to purchase inferior products. This would be a faulty belief! Instead, firms benefit when their domestic customers have high expectations.

Japanese consumers are known for insisting on very high levels of quality, aesthetics, and reliability. Japanese automakers such as Honda, Toyota, and Nissan reap rewards from this situation. These firms have to work hard to satisfy their domestic buyers. Living up to lofty quality standards at home prepares these firms to offer high-quality products when competing in international markets. In contrast, French car buyers do not stand out as particularly fussy. It is probably not a coincidence that French automakers Renault and Peugeot have struggled to gain traction within the global auto industry.

Demand conditions also help to explain why German automakers such as Porsche, Mercedes-Benz, and BMW create excellent luxury and high-performance vehicles. German consumers value superb engineering. While a car is simply a means of transportation in some cultures, Germans place value on the concept of fahrvergnügen, which means “driving pleasure.” Meanwhile, demand for fast cars is high in Germany because the country has built nearly 8,000 miles of superhighways known as autobahns. No speed limits for cars are enforced on more than half of the 8,000 miles. Many Germans enjoy driving at 150 miles per hour or more, and German automakers must build cars capable of safely reaching and maintaining such speeds. When these companies compete in the international arena, the engineering and performance of their vehicles stand out.

Factor Conditions

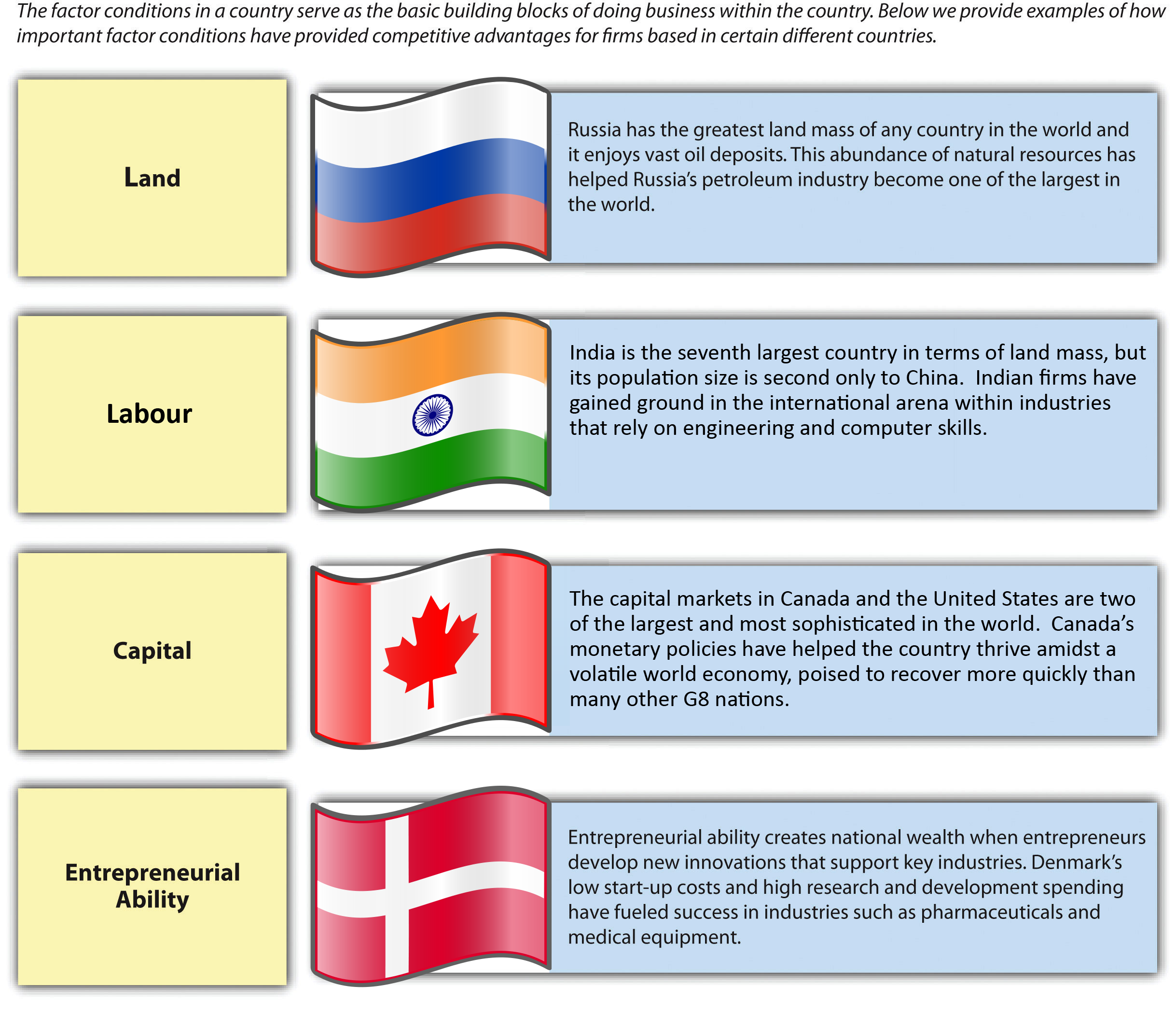

Factor conditions refer to the nature of raw material and other inputs, including qualified labor, that firms need to create goods and services (Figure 7.17 “Factor Conditions”). Examples include land, labor, capital markets, and infrastructure. Firms benefit when they have good access to factor conditions and face challenges when they do not. Companies based in Canada and the United States, for example, are able to draw on plentiful natural resources, a skilled labor force, highly developed transportation systems, and sophisticated capital markets to be successful. The dramatic growth of Chinese manufacturers in recent years has been fueled in part by the availability of cheap labor and access to cheap capital.

In some cases, overcoming disadvantages in factor conditions leads companies to develop unique skills. Japan is a relatively small island nation with little room to spare. This situation has led Japanese firms to be pioneers in the efficient use of warehouse space through systems such as just-in-time inventory management (JIT). Rather than storing large amounts of parts and material, JIT management conserves space—and lowers costs—by requiring inputs to a production process to arrive at the moment they are needed. Their use of JIT management has given Japanese manufacturers an advantage when they compete in international markets.

Related and Supporting Industries

Could Italian shoemakers create some of the world’s best shoes if Italian leather tanners were not among the world’s best? Possibly, but it would be much more difficult. The concept of related and supporting industries refers to the extent to which firms’ domestic suppliers and other complementary industries are developed and helpful (Figure 7.19 “Related and Supporting Industries”). Italian shoemakers such as Salvatore Ferragamo, Prada, Gucci, and Versace benefit from the availability of top-quality leather within their home country. If these shoemakers needed to rely on imported leather, they would lose some of their flexibility and speed.

The auto industry is a setting where related and supporting industries are very important. Electronics are key components of modern vehicles. South Korean automakers Kia and Hyundai can leverage the excellent electronics provided by South Korean firms Samsung and LG. Similarly, Honda, Nissan, and Toyota are able to draw on the skills of Sony and other Japanese electronics firms. Unfortunately, for French automakers Renault and Peugeot, no French electronics firms are standouts in the international arena. This situation makes it difficult for Renault and Peugeot to integrate electronics into their vehicles as effectively as their South Korean and Japanese rivals.

The development of the international Detroit(U.S.)/Windsor (Canada) car manufacturing hub saw many component manufacturing companies set up shop in the region to be near the Big Three auto manufacturing plants. This initiative was accelerated with just-in-time supply chain management. The relatively close location of these manufacturing and design firms continues to attract a strong labor force of engineers and designers of car components and parts, resulting in many new ideas for car manufacturing.

In extreme cases, the poor condition of related and supporting industries can undermine an operation. Kaufman Footwear, formerly the Kaufman Rubber Company, was a shoe manufacturing company in Kitchener, Ontario, that produced well-known brands such as Sorel winter boots, Kingtread work boots, Foamtread slippers, and Black Diamond industrial footwear. The company had sales warehouses across Canada. The Kaufman plant opened in 1908 with 350 employees, and produced rubber footwear for both domestic and foreign markets. By the 1950s, the Canadian rubber footwear industry was feeling the impact of competing imported products, so Kaufman Rubber began manufacturing footwear made from synthetic materials. In 1982, Canada removed import quotas from leather shoe imports, which eventually snowballed into the demise of much of its national shoe industry. Kaufman declared bankruptcy in 2000, one of the many Canadian shoe manufacturers unable to compete in the face of increased global competition. The Sorel trademark was bought by Columbia Sportswear and continues the brand name today. Canada still has several highly specialized footwear manufacturers, including Boulet Boots, Blondo, La Canadienne, Cougar, Dayton Boots, John Fleuvog, Kamik, Pajar, Roots, and Sorel Footwear.

Firm Strategy, Structure, and Rivalry

The concept of firm strategy, structure, and rivalry refers to how challenging it is to survive domestic competition (Figure 7.21 “Strategy, Structure, and Rivalry”). The Olympics offer a good analogy for illustrating the positive aspects of very challenging domestic situations. If the competition to make a national team in gymnastics is fierce, the gymnasts who make the team will have been pushed to stretch their abilities and performance. In contrast, gymnasts who faced few contenders in their quest to make a national team will not have been tested with the same level of intensity. When the two types meet at the Olympics, the gymnasts who overcame huge hurdles to make their national teams are likely to have an edge over athletes from countries with few skilled gymnasts.

Companies that have survived intense rivalry within their home markets are likely to have developed strategies and structures that will facilitate their success when they compete in international markets. Hyundai and Kia had to keep pace with each other within the South Korean market before expanding overseas. The leading Japanese automakers—Honda, Nissan, and Toyota—have had to compete not only with one another but also with smaller yet still potent domestic firms such as Isuzu, Mazda, Mitsubishi, Subaru, and Suzuki. In both examples, the need to navigate potent domestic rivals has helped firms later become fearsome international players.

If, in contrast, domestic competition is fairly light, a company may enjoy admirable profits within its home market. However, the lack of being pushed by rivals will likely mean that the firm struggles to reach its full potential in creativity and innovation. This undermines the firm’s ability to compete overseas and even makes it vulnerable to foreign entry into its home market. Because neither Renault nor Peugeot has been a remarkable innovator historically, these French automakers have enjoyed fairly gentle domestic competition. Once the auto industry became a more global marketplace and competition, however, these firms found themselves trailing their Asian rivals.

Key Takeaways

- The likelihood that a firm will succeed when it competes in international markets is shaped by four aspects of its domestic market: (1) demand conditions; (2) factor conditions; (3) related and supporting industries; and (4) strategy, structure, and rivalry among its domestic competitors.

Exercises

- Which of the four elements of the diamond model do you believe has the strongest influence on a firm’s fate when it competes in international markets?

- Automakers in China and India have yet to compete on the world stage. Based on the diamond model, would these firms be likely to succeed or fail within the global auto industry?

References

Aeppel, T. (2008, March 3). US shoe factory finds supplies are Achilles’ heel. Wall Street Journal. Retrieved from http://online.wsj.com/article/SB120450124543206313.html

Friedman, T. L. (2005). The world is flat: A brief history of the 21st century. New York, NY: Farrar, Straus and Giroux.

Porter, M. E. (1990). The competitive advantage of nations. New York, NY: Free Press.

Image description

Figure 7.14 image description: The Diamond Model of National Advantage

Diamonds may be a country’s best friend. Around half of the world’s diamonds are mined in South Africa, giving that country a unique advantage in the global diamond industry. Porter’s Determinants of National Advantage (often referred to as the diamond model) includes four key dimensions that help explain why firms located in certain countries are more successful than others in particular industries.

- Strategy, Structure, and Rivalry — Canada has an overall trade deficit, but it depends in part on the value of the loonie compared to world currencies. When the Canadian dollar is relatively low, Canada exports autos, planes and energy at a higher than normal rate.

- Related and Supporting Industries — Firms benefit when their domestic suppliers and other complementary industries are developed and helpful. Italy’s fashion industry is enhanced by the abundance of fine Italian leather and well-known designers.

- Demand Conditions – Fussy domestic customers help firms prepare for the global arena. Japanese firms must create excellent goods to meet Japanese consumers’ high expectations about quality, aesthetics, and reliability.

- Factor Conditions — The inputs present in a country shape firms’ global competitiveness. The rapid growth of Chinese manufacturers has been fueled by the availability of cheap labor.

Figure 7.15 image description: Demand Condition

Within the diamond model, demand conditions refer to the nature of domestic customers. Below we provide examples the auto industry that illustrate domestic customers influence firms’ ability to compete in the global arena.

- Japanese consumers insist on very high levels of quality, aesthetics, and reliability, This forces Honda, VCYOta, and Nissan to rise to a difficult challenge as well as preparing them to dominate internationally.

- Because French car buyers are not particularly picky, Renault and Peugeot have not been forced to in their market. Not surprisingly, they have struggled to gain traction within the global auto industry.

- Germans place value on the concept of fahrvergnügen, which means “driving pleasure.” Customers around the globe driving pleasure When purchasing Cars from BMW. Mercedes-Benz, Porsche, and Volkswagen.

- The Italian fascination with styling is evident in luxury car brands such as Alfa Romeo, Ferrari, Lamborghini, and Maserati.

- To some North Americans, bigger is better. This attitude was captured by the Hummer. Originally developed for military use, GM it in 2010 due to lack of demand and high gas prices.

Figure 7.17 image description: Factor Conditions

The factor conditions in a country serve as the basic building blocks of doing business within the country. Below we provide examples of how important factor conditions have provided competitive advantages for firms based in certain different countries.

- Land – Russia has the greatest land mass of any country in the world and it enjoys vast oil deposits. This abundance of natural resources has helped Russia’s petroleum industry become one of the largest in the world.

- Labour – India is the seventh largest country in terms Of land mass, but its population size is second only to China. Indian firms have gained ground in the international arena within industries that rely on engineering and computer skills.

- Capital – The capital markets in Canada and the United States are two of the largest and most sophisticated in the world. Canada’s monetary policies have helped the country thrive amidst a volatile world economy, poised to recover more quickly than many other G8 nations.

- Entrepreneurial ability – Entrepreneurial ability creates national wealth when entrepreneurs develop new innovations that support key industries. Denmark’s low start-up costs and high research and development spending have fueled success in industries such as pharmaceuticals and medical equipment.

Figure 7.19 image description: Related and Supporting Industries

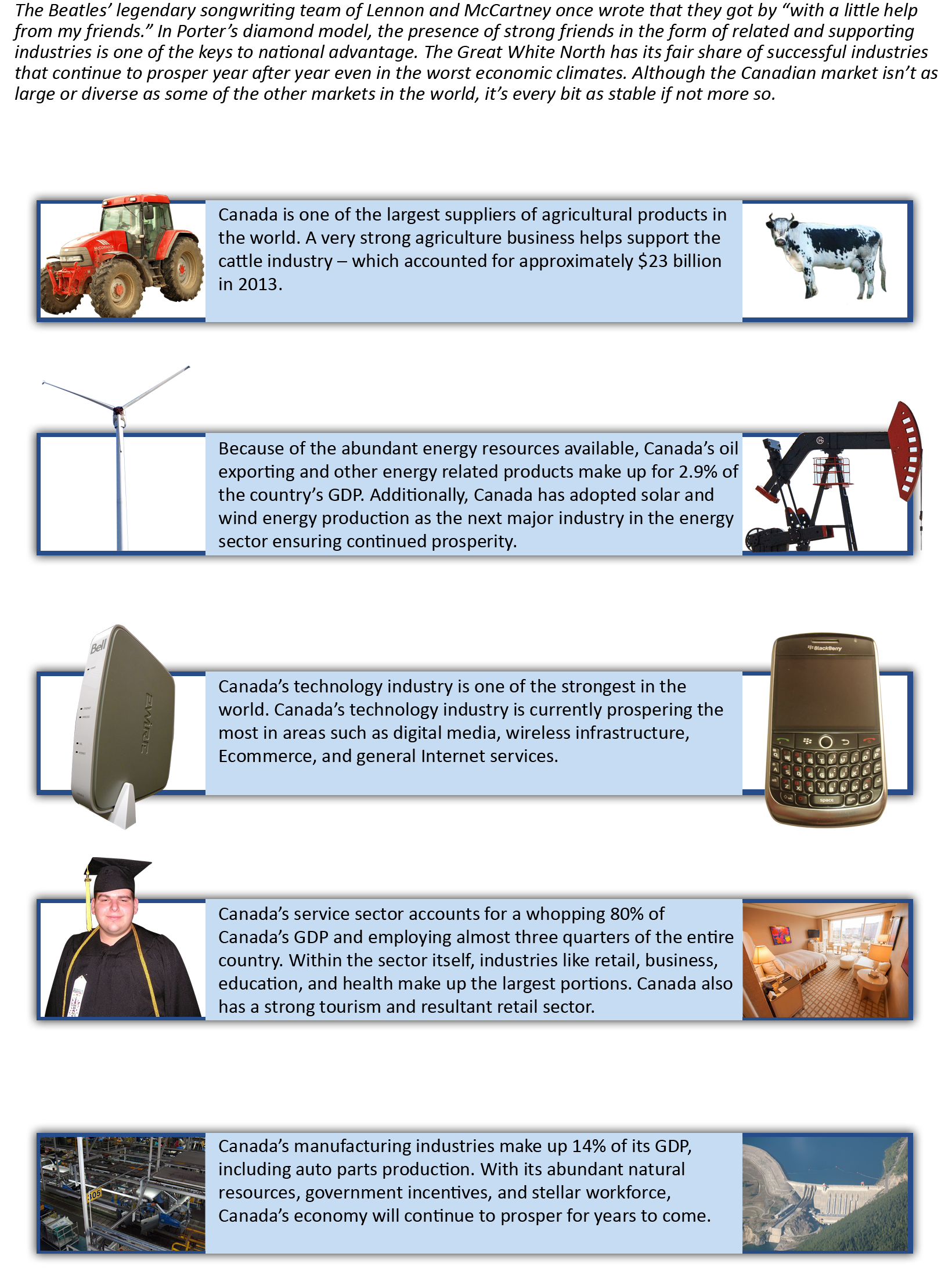

The Beatles’ legendary songwriting team of Lennon and McCartney once wrote that they got by “with a little help from my friends. ” In Porter’s diamond model, the presence of strong friends in the form of related and supporting industries is one of the keys to national advantage. the Great White North has its fair share of successful industrie that continue to prosper year after year even in the worst economic climates. Although the Canadian market isn’t large or diverse as some of the other markets in the world, it’s every bit as stable if not more so.

- Canada is one Of the largest suppliers Of agricultural products in the world, A very strong agriculture business helps support the cattle industry — which accounted for approximately $23 billion in 2013.

- Canada’s service sector accounts for a whopping 80% of Canada’s GDP and employing almost three quarters Of the entire country. Within the sector itself, industries like retail, business, education, and health make up the largest portions. Canada also has a strong tourism and resultant retail sector.

- Canada’s manufacturing industries make up 14% of its GDP, including auto parts production. With its abundant natural resources, government incentives, and stellar workforce, Canada’s economy Will continue to prosper for years to come.

- Because of the abundant energy resources available, Canada’s Oil exporting and Other energy related products make up for 2.9% Of the country’s GDP. Additionally, Canada has adopted solar and Wind energy production as the next major industry in the energy sector ensuring continued prosperity.

- Canada’s technology industry is one Of the strongest in the world. Canada’s technology industry is currently prospering the most in areas such as digital media, wireless infrastructure, Ecommerce, and general Internet services.

Figure 7.21 image description: Strategy, Structure, and Rivalry

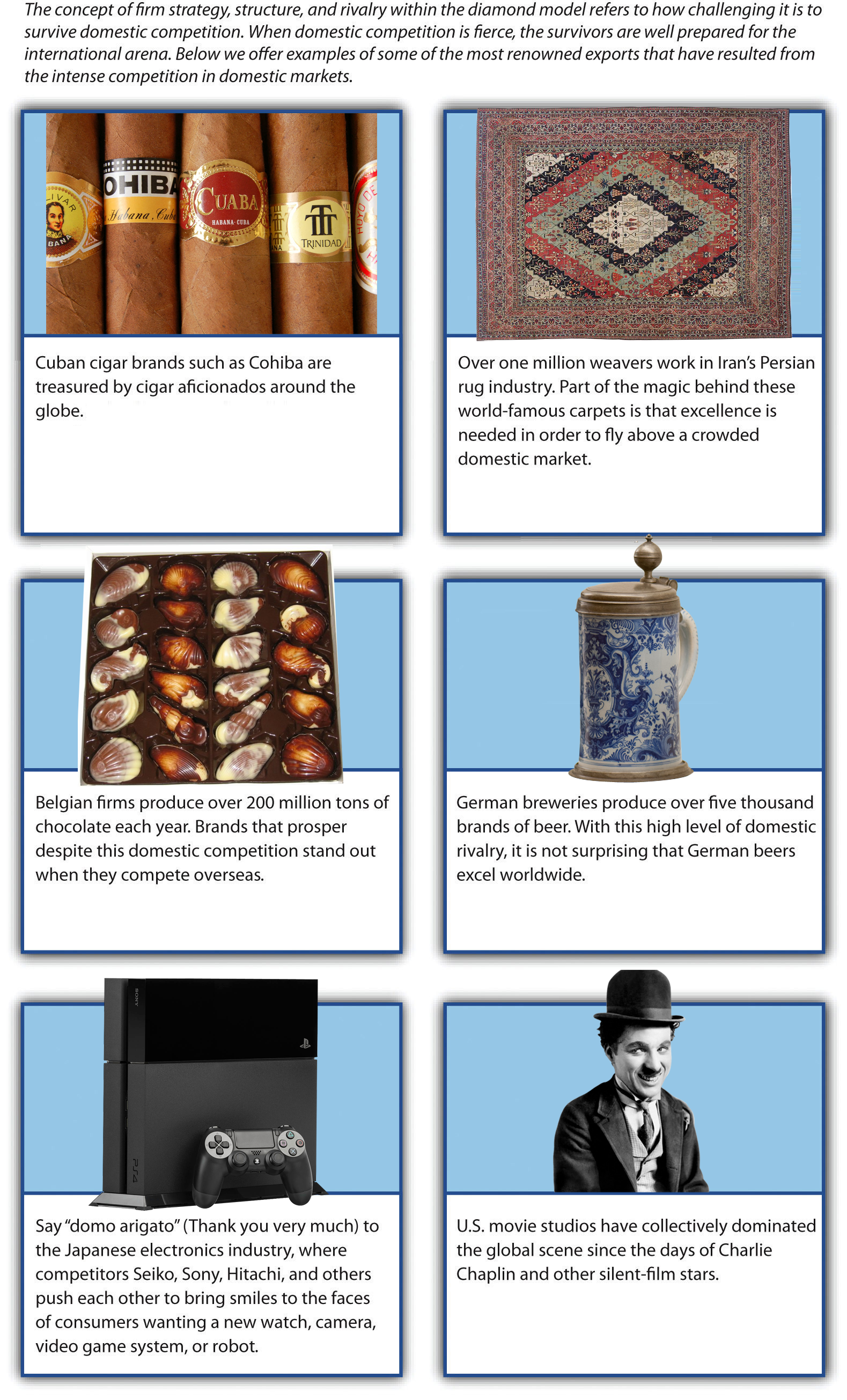

The concept of firm strategy, structure and within the diamond model refers to how challenging it is to survive domestic competition. When domestic competition is fierce. the survivors are well prepared for the international arena. Below we offer some of the most renowned exports that have resulted the intense in domestic markets.

- Cuban cigar such as Cohiba are treasured by Cigar aficionados around the globe

- Belgian firms produce 200 million of tons of Chocolate each year. Brands that prosper despite this domestic competition stand out when they compete overseas.

- Say “domo arigato” (Thank you very much) to the Japanese electronics industry, where competitors Seiko, Sony, Hitachi, and others push each other to bring smiles to faces of consumers wanting a new watch, camera. Video game or robot.

- Over one million weavers in Persian rug industry. Part of the magic behind these world-famous carpets is that

excellence is needed in order to fly above a crowded domestic market. - German breweries over five thousand brands Of beer. With this high level Of domestic rivalry, it is not surprising that German beers excel worldwide.

- U.S, movie studios have collectively dominated the global scene since the days of Charlie Chaplin and other silent-film stars.

Media Attributions

- Diamond Paperweight 8-24-09 4 © Steven Depolo is licensed under a CC BY (Attribution) license

- Figure 7.15: Attribution information for all included images is in the chapter conclusion.

- FEMA – 46187 – Japanese Delegations Visits FEMA Louisiana Recovery Office © Manny Broussard is licensed under a Public Domain license

- Figure 7.17: Attribution information for all included images is in the chapter conclusion.

- Bois coupé dans le hangar © Dinkum is licensed under a CC0 (Creative Commons Zero) license

- Figure 7.19: Attribution information for all included images is in the chapter conclusion.

- Milan Montenapoleone 16 © Warburg is licensed under a CC BY-SA (Attribution ShareAlike) license

- Figure 7.21: Attribution information for all included images is in the chapter conclusion.

- Leicester Square Burger King © Chrisloader is licensed under a CC BY-SA (Attribution ShareAlike) license

The nature of domestic customers, especially whether they have high expectations of the goods and services that they buy.

The nature of raw material and other inputs that firms need to create goods and services.

A production system that conserves space and lowers costs by requiring inputs to arrive at the moment they are needed.

The extent to which firms’ domestic suppliers and other complementary industries are developed and helpful.

How challenging it is for firms to survive domestic competition.