Chapter 7: Competing in International Markets

Options for Competing in International Markets

Learning Objectives

- Understand the various options for entering an international market.

- Be able to provide an example of a firm using each option.

When the executives in charge of a firm decide to enter a new country, they must decide how best to do it. There are five basic options available: (1) exporting, (2) creating a wholly owned subsidiary, (3) franchising, (4) licensing, and (5) creating a joint venture or strategic alliance (Figure 7.25 “Market entry options”). These options vary in terms of how much control a firm has over its operation, initial cost of entry, how much risk is involved, and what share of the operation’s profits the firm gets to keep.

Exporting

Exporting involves creating goods within a firm’s home country and then shipping them to another country. Once the goods reach foreign shores, the exporter’s role is over. A local firm then sells the goods to local customers. Many firms that expand overseas start out as exporters because exporting offers a low-cost method to find out whether a firm’s products are appealing to customers in other lands. Some Asian automakers, for example, first entered the U.S. market through exporting. Small firms may rely on exporting because it is a low-cost option.

Once a firm’s products are found to be viable in a particular country, exporting often becomes undesirable. A firm that exports its goods loses control of them once they are turned over to a local firm for sale locally. This local distributor may treat customers poorly and thereby damage the firm’s brand. Also, an exporter only makes money when it sells its goods to a local firm, not when end users buy the goods. Executives may want their firm rather than a local distributor to enjoy the profits that are made when products are sold to individual customers.

Licensing

While franchising is an option within service industries, licensing is most frequently used in manufacturing industries. Licensing involves granting a foreign company the right to create a company’s product within a foreign country in exchange for a fee. These relationships often centre on patented technology. A firm that grants a license avoids absorbing a lot of startup costs, but typically loses some control over how its technology is used, including quality control. Profits are limited to the fees that it collects from the local firm and firms must be aware of the degree of risk to intellectual property loss.

A historical example involving licensing illustrates how rapidly events can change within the international arena. By the time Japan surrendered to the United States and its Allies in 1945, World War II had crippled the country’s industrial infrastructure. In response to this problem, Japanese firms imported a great deal of technology, especially from American firms. When the Korean War broke out in the early 1950s, the American military relied on Jeeps made in Japan using licensed technology. In just a few years, a mortal enemy had become a valuable ally.

Franchising

Franchising has been used by many firms that compete in service industries to develop a worldwide presence (Figure 7.27 “Franchising: A Leading American Export”). Subway, the UPS Store, and Hilton Hotels are just a few of the firms that have done so. Franchising involves an organization (called a franchisor) granting the right to use its brand name, products, and processes to other organizations (known as franchisees) in exchange for an upfront payment (a franchise fee) and a percentage of franchisees’ revenues (a royalty fee).

Franchising is an attractive way to enter foreign markets because it requires little financial investment by the franchisor. Indeed, local franchisees must pay the vast majority of the expenses associated with getting their businesses up and running. On the downside, the decision to franchise means that a firm will get to enjoy only a small portion of the profits made under its brand name. Also, local franchisees may behave in ways that the franchisor does not approve. For example, KFC was angered by some of its franchisees in Asia when they started selling fish dishes without KFC’s approval. It is often difficult to fix such problems because laws in many countries favor local businesses. As well, franchises are only successful if franchisees are provided with a simple and effective business model. Executives thus need to avoid expanding internationally through franchising until their formula has been perfected.

However, no franchise is a foolproof money maker. Tim Hortons, Canada’s largest fast-food restaurant, began a partnership with the American dairy chain Cold Stone Creamery in 2009, but ended the affiliation in 2014. Tim Hortons has about 3,600 stores in Canada, almost 900 in United States and about 40 in the Persian Gulf. Initially, the U.S. stores were the result of natural expansion in Canadian border areas. However, in 2010, Tim Hortons announced it was closing 36 stores in the northeastern United States due to high competition in the New England area. Those stores, now closed, made less than half the average company per store sales. In the announcement, the company stated that it would concentrate its efforts on its core markets such as Western Canada. To that end, in 2014, the firm announced the planned opening of another 500 stores in Canada, and a return to the United States with 300 new stores opening there too (Shaw, 2014).

Strategy at the Movies

Gung Ho

Can American workers survive under Japanese management? Although this sounds like the premise for a bad reality TV show, the question was a legitimate consideration for General Motors (GM) and Toyota in the early 1980s. GM was struggling at the time to compete with the inexpensive, reliable, and fuel-efficient cars produced by Japanese firms. Meanwhile, Toyota was worried that the U.S. government would limit the number of foreign cars that could be imported. To address these issues, these companies worked together to reopen a defunct GM plant in Fremont, California, in 1984 that would manufacture both companies’ automobiles in one facility. The plant had been the worst performer in the GM system; however, under Toyota’s management, the New United Motor Manufacturing Incorporated (NUMMI) plant became the best factory associated with GM—using the same workers as before! Despite NUMMI’s eventual success, the joint production plant experienced significant growing pains stemming from the cultural differences between Japanese managers and American workers.

The NUMMI story inspired the 1986 movie Gung Ho in which a closed automobile manufacturing plant in Hadleyville, Pennsylvania, was reopened by Japanese car company Assan Motors. While Assan Motors and the workers of Hadleyville were both excited about the venture, neither was prepared for the differences between the two cultures. For example, Japanese workers feel personally ashamed when they make a mistake. When manager Oishi Kazihiro failed to meet production targets, he was punished with “ribbons of shame” and forced to apologize to his employees for letting them down. In contrast, American workers were presented in the film as likely to reject management authority, prone to fighting at work, and not opposed to taking shortcuts.

When Assan Motors’ executives attempted to institute morning calisthenics and insisted that employees work late without overtime pay, the American workers challenged these policies and eventually walked off the production line. Assan Motors’ near failure was the result of differences in cultural norms and values. Gung Ho illustrates the value of understanding and bridging cultural differences to facilitate successful cross-cultural collaboration, value that was realized in real life by NUMMI.

Joint Ventures and Strategic Alliances

Within each market entry option, a firm must choose between maintaining strong control of operations (wholly owned subsidiary) or turning most control over to a local firm (exporting, franchising, and licensing). In some cases, however, executives find it beneficial to work closely with one or more local partners in a joint venture or a strategic alliance. In a joint venture, two or more organizations each contribute to the creation of a new entity. In a strategic alliance, firms work together cooperatively, but no new organization is formed. In both cases, the firm and its local partner or partners share decision-making authority, control of the operation, and any profits that the relationship creates.

Joint ventures and strategic alliances are especially attractive when a firm believes that working closely with locals will provide it with important knowledge about local conditions and facilitate acceptance of their involvement by government officials and consumers. In the late 1980s, China was a difficult market for North American businesses to enter. Executives at KFC saw China as an attractive country because chicken is a key element of Chinese diets. After considering the various options for entering China with its first restaurant, KFC decided to create a joint venture with three local organizations. KFC owned 51 percent of the venture; having more than half of the operation was advantageous in case disagreements arose. A Chinese bank owned 25 percent, the local tourist bureau owned 14 percent, and the final 10 percent was owned by a local chicken producer who would supply the restaurant with its signature food item.

Having these three local partners helped KFC navigate the cumbersome regulatory process that was in place and allowed the American firm to withstand the scrutiny of wary Chinese officials. Despite these advantages, it still took more than a year for the store to be built and approved. Once open in 1987, however, KFC was an instant success in China. As China’s economy gradually became more and more open, KFC was a major beneficiary. By the end of 1997, KFC operated 191 restaurants in 50 Chinese cities. By the start of 2011, there were approximately 3,200 KFCs spread across 850 Chinese cites. Roughly 90 percent of these restaurants are wholly owned subsidiaries of KFC—a stark indication of how much doing business in China has changed over the past twenty-five years.

Creating a Wholly Owned Subsidiary

A wholly owned subsidiary is a business operation in a foreign country that a firm fully owns. A firm can develop a wholly owned subsidiary through a greenfield venture, meaning that the firm creates the entire operation itself. Another possibility is purchasing an existing operation from a local company or another foreign operator.

Regardless of whether a firm builds a wholly owned subsidiary “from scratch” or purchases an existing operation, having a wholly owned subsidiary can be attractive because the firm maintains complete control over the operation and gets to keep all of the profits (or losses) that the operation makes. A wholly owned subsidiary can be quite risky, however, because the firm must pay all of the expenses required to set it up and operate it. Kia, for example, spent $1 billion to build its U.S. factory. Many firms are reluctant to spend such sums, especially in more volatile countries, because they fear that they may never recoup their investments.

Key Takeaways

- When entering a new country, executives can choose exporting, creating a wholly owned subsidiary, franchising, licensing, and creating a joint venture or strategic alliance. The key issues of how much control a firm has over its operation, how much risk is involved, and what share of the operation’s profits the firm gets to keep all vary across these options.

Exercises

- Do you believe that KFC would have been so successful in China today if executives had tried to make their first store a wholly owned subsidiary? Why or why not?

- The typical joint venture only lasts a few years. Why might joint ventures dissolve so quickly?

References

Shaw, H. 2014, February 25. Tim Hortons Inc to open 500 new stores in Canada, 300 in U.S. Financial Post. Retrieved from http://business.financialpost.com/2014/02/25/tim-hortons-inc-to-open-800-new-stores/

Image description

Figure 7.25 image description: Market entry options

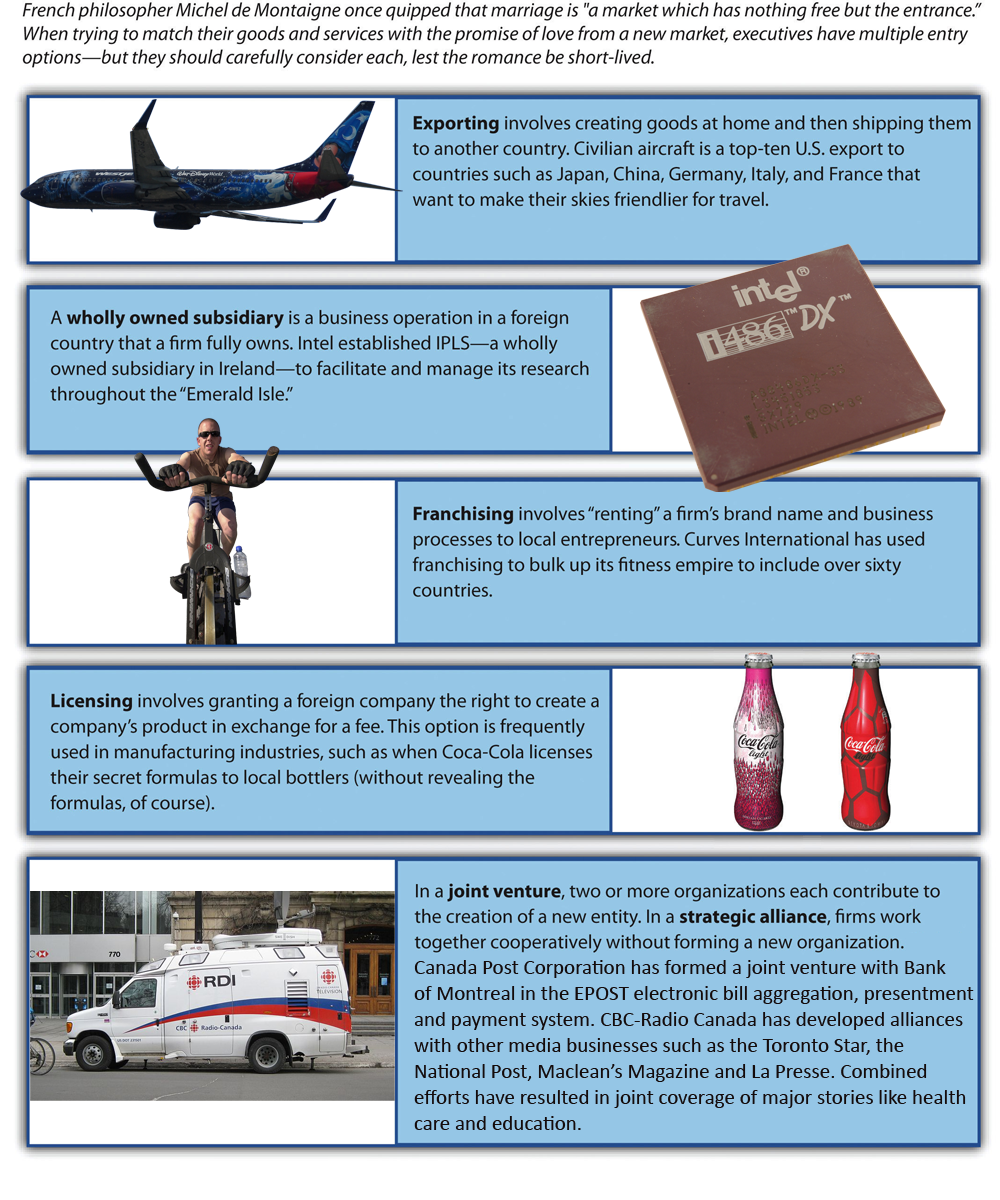

French philosopher Michel de Montaigne once quipped that marriage is “a market which has nothing free but the entrance.” When trying to match their goods and services With the promise Of “Ove from a new market, executives have multiple entry options—but they should carefully consider each, lest the romance be short-lived.

- Exporting involves creating goods at home and then shipping them to another country. Civilian aircraft is a top-ten U.S. export to countries such as Japan, China, Germany, Italy, and France that want to make their skies friendlier for travel.

- A wholly owned subsidiary is a business operation in a foreign country that a firm fully owns. Intel established IPLS—a wholly owned subsidiary in Ireland—to facilitate and manage its research throughout the “Emerald Isle.”

- Franchising involves “renting” a firm’s brand name and business processes to local entrepreneurs. Curves International has used franchising to bulk up its fitness empire to include over sixty countries.

- Licensing involves granting a foreign company the right to create a company’s product in exchange for a fee. This option is frequently used in manufacturing industries, such as when Coca-Cola licenses their secret formulas to local bottlers (Without revealing the formulas, of course).

- In a joint venture, two or more organizations each contribute to the Creation Of a new entity. In a strategic alliance, firms work together cooperatively without forming a new organization. Canada post Corporation has formed a joint venture with Bank of Montreal in the EPOST electronic bill aggregation, presentment and payment system. CBC-Radio Canada has developed alliances with other media businesses such as the Toronto Star, the National Post, Maclean’s Magazine and La Presse. Combined efforts have resulted in joint coverage ot major stories like health care and education.

Figure 7.27 image description: Franchising: A Leading American Export

Franchising is a popular way for firms to grow internationally. Below we provide examples of US-based franchises that are successful worldwide.

- In many Asian countries, McDonald’s franchises offer side dishes such as rice alongside its signature French fries.

- If you long for a taste of home, you can get your Tim’s in Canada’s border areas of the USA, or even in Dubai.

- Legend says that the first sandwich was created when John Montagu, the fourth Earl Of Sandwich, ordered meat tucked between bread so he could play cards and eat at the same time. The sandwich remains popular in Europe, where Subway boasts over one thousand franchised restaurants.

- All KFCs in Japan prominently feature a statue of KFC’s founder Colonel Sanders.

- If this franchised store in Norway was open during the age Of the Vikings, its slogan may have been “Thank Asgard for 7—11 .”

Media Attributions

- Figure 7.25: Attribution information for all included images is in the chapter conclusion.

- Container ship CSCL Venus of the China Shipping Line outgoing Hamburg in April 2014 © Buonasera is licensed under a CC BY-SA (Attribution ShareAlike) license

- Figure 7.27: Attribution information for all included images is in the chapter conclusion.

- 1965 Ford Mustang Assembly Line in Dearborn, Michigan © Alden Jewell is licensed under a CC BY (Attribution) license

- KFC China © 陳炬燵 is licensed under a CC BY-SA (Attribution ShareAlike) license

Creating goods within a firm’s home country and then shipping them to another country where they are sold to customers by a local firm.

One organization grants another the right to create its product, often using patented technology, in exchange for a fee.

An organization (called a franchisor) grants the right to use its brand name, products, and processes to other organizations (known as franchisees) in exchange for an up-front payment (a franchise fee) and a percentage of franchisees’ revenues (a royalty fee).

A business operation in a foreign country that a firm fully owns.

A foreign operation that a firm creates entirely by itself.