Chapter 5: Selecting Business-Level Strategy

Stuck in the Middle

Learning Objectives

- Describe the problem of being stuck in the middle of different generic strategies.

- Understand why trying to please everyone often creates problems when crafting a business-level strategy.

Stuck in the Middle: Neither Inexpensive nor Differentiated

Some firms fail to effectively pursue one of the generic strategies. A firm is said to be stuck in the middle if it does not offer features that are unique enough to convince customers to buy its offerings, and its prices are too high to compete effectively based on price (Figure 5.23 “Stuck in the Middle”). Arby’s appears to be a good example. Arby’s signature roast beef sandwiches are neither cheaper than other fast-food sandwiches nor standouts in taste. Firms that are stuck in the middle generally perform poorly because they lack a clear market or competitive pricing. Perhaps not surprisingly, parent company Wendy’s sold Arby’s in 2011.

Arby’s has turned its sales around in its three years as a private chain. Arby’s senior vice president of finance said that the brand had “lost its way” when owned by Wendy’s from 2008 through 2010. The company had struggled with weak sales for years and blamed leadership changes, inconsistent brand positioning, reduced service levels, underinvestment, and limited product innovation.

Arby’s has since added several menu items and taken almost a dozen offerings away. Products were removed from the menu that didn’t drive enough sales and were either too complicated to prepare or took up too much space. The chain’s same-store sales have increased in each of the past three years, including 4.3 percent in 2011 and 2.8 percent in each of the past two years (Maze, 2014).

Doing Everything Means Doing Nothing Well

Michael Porter has noted that strategy is as much about executives deciding what a firm is not going to do as it is about deciding what the firm is going to do (Porter, 1996). In other words, a firm’s business-level strategy should not involve trying to serve the varied needs of different segment of customers in an industry. No firm could possibly pull this off.

The fable “The Miller, His Son, and Their Ass” told by the ancient Greek storyteller Aesop helps illustrate this idea. In this tale, a miller and his son were driving their ass (donkey) to market for sale. They soon encountered a group of girls who mocked them for walking instead of riding. The father then told his son to ride the animal. Not long after, father and son overheard a man claim that young people had no respect for the elderly. On hearing this opinion, the father told the boy to dismount the animal and he began to ride. They progressed a short distance farther and met a company of women and children. Several of the women suggested that it was both ridiculous and lazy for the father to ride while the young son was forced to walk alone; once again the two changed positions. Another bystander suggested that they could not believe that the man was the owner of the beast, judging from the way it was weighted down. In fact, it would make more sense for the man and his son to carry the ass. On hearing this, the father and his son tied the animal’s legs together and carried it on a pole. As they crossed a bridge near town, the townspeople began to gather and laugh at the unorthodox sight. The noise and the chaos frightened the beast, leading it to thrash around until it tumbled into the river. With tongue in cheek, we note that the moral of the story is that if you try to please everyone, you may lose your ass (Short & Ketchen, 2005).

Getting Outmaneuvered by Competitors

In many cases, firms become stuck in the middle not because executives fail to arrive at a well-defined strategy but because firms are simply outmaneuvered by their rivals. After six decades as an electronics retailer, Circuit City went out of business in 2009. The firm had simply lost its appeal to customers. Rival electronics retailer Best Buy and Future Shop offered comparable prices to Circuit City’s prices, but the former offered much better customer service. Meanwhile, the service offered by discount retailers such as Walmart and Target on electronics were no better that Circuit City’s, but their prices were better.

The results were predictable—customers who made electronics purchases based on the service they received went to Best Buy, and value-driven buyers patronized Walmart and Target. Circuit City’s demise was probably inevitable because it lacked a competitive advantage within the electronics business. Although Target was on the winning end of this battle, Target executives need to worry that their firm could become stuck in the middle between Walmart’s better prices on one side and the trendiness of specialty shops on the other.

IBM’s personal computer business offers another example. IBM tried to position its personal computers via a differentiation strategy. In particular, IBM’s personal computers were offered at high prices, and the firm promised to offer excellent service to customers in return. Unfortunately for IBM, rivals such as Dell were able to provide equal levels of service while selling computers at lower prices. Nothing made IBM’s computers stand out from the crowd, and the firm eventually exited the business.

At its peak in the mid-2000s, Blockbuster operated approximately 400 video rental stores in Canada. By 2011, the firm was dead. This rapid demise can be traced to the firm becoming outmaneuvered by Netflix. When Netflix began offering inexpensive DVD rentals through the mail, customers defected in droves from Blockbuster and other video rental stores. Netflix customers were delighted by the firm’s low prices, vast selection, and the convenience of not having to visit a store to select and return videos. Blockbuster was stuck in the middle—its prices were higher than those of Netflix, and Netflix’s service was superior. Once individuals lacked a compelling reason to be Blockbuster customers, the firm’s fate was sealed. Since then, Netflix’s DVD subscription service has seen a major change in fortunes, going from fourteen million subscribers in 2011 to half that in the third quarter of 2013, reflecting the decline of physical media in favor of the cheaper and more easily accessible digital forms.

More Canadians are abandoning traditional telephones and TV services, reflecting a growing trend prompted by changing lifestyles, according to a new study.

The Convergence Consulting Group said that by the end of 2014 it expects 26.3 percent of Canadian households will be going without landline telephones and relying solely on wireless telephone service. That is up from 22.5 percent in 2013. Households are also increasingly abandoning traditional TV in favor of programming from other sources such as Netflix and other online services. By the end of this year, TV subscriptions that will rely only on Netflix and other online services will reach 665,000 households, or 5.7 percent, according to the study, which is based on statistics from cable, satellite, and telecom companies as well as Convergence’s own analysis (The Canadian Press, 2014).

Key Takeaways

- When executing a business-level strategy, a firm must not become stuck in the middle between viable generic business-level strategies by offering neither unique features nor competitive pricing.

Exercises

- What is an example of a firm that you would consider to be “stuck in the middle”? What would your advice be to the executives in charge of this firm?

- Research a company that has gone bankrupt or otherwise stopped operations in the past decade because their strategy was “stuck in the middle” of otherwise viable generic business-level strategies. Could its demise have been prevented?

References

Maze, J. (2014). New Products Have Been Really Good For Arby’s. Retrieved from http://www.restfinance.com/Restaurant-Finance-Across-America/March-2014/New-Products-Have-Been-Really-Good-For-Arbys/

McWilliams, J. (2011, January 21). Wendy’s/Arby’s to try to sell Arby’s. Atlantic Journal-Constitution. Retrieved from http://www.ajc.com/business/wendys-arbys-to- try-810320.html

Porter, M. E. (1996). What is strategy? Harvard Business Review, reprint 96608.

Short, J. C., & Ketchen, D. J. (2005). Using classic literature to teach timeless truths: An illustration using Aesop’s fables to teach strategic management. Journal of Management Education, 29(6), 816–832.

The Canadian Press. (2014). Cord-cutting continues as Canadians ditch TVs & landlines. Retrieved from http://www.cbc.ca/news/business/cord-cutting-continues-as-canadians-ditch-tv-landlines-1.2601373

Image descriptions

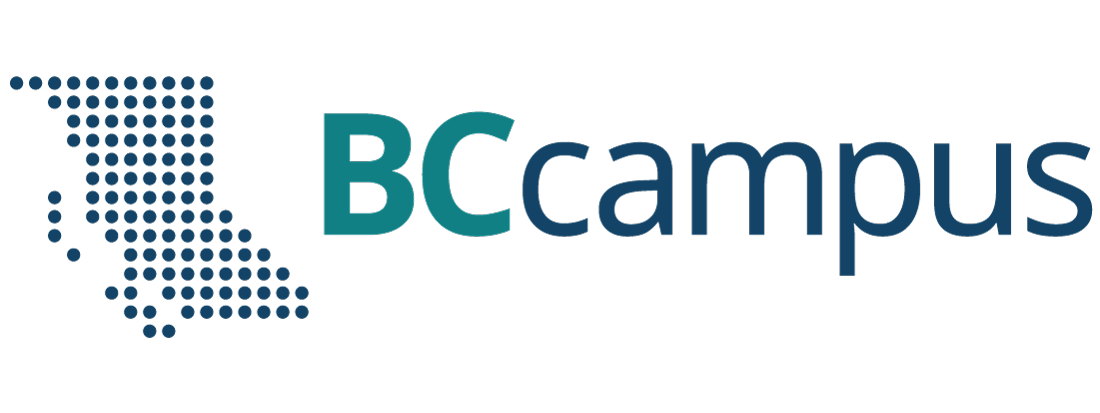

Figure 5.23 image description: Stuck in the Middle

A firm is said to be stuck in the middle if it does not offer features that are unique enough to convince customers to buy its offerings and its prices are too high to effectively compete based on price. Firms that are stuck in the middle generally perform poorly because they lack a clear market or competitive pricing. Several examples of such firms are illustrated below.

- Arby’s signature roast beef sandwiches are neither cheaper than other fast food nor are they standouts in taste. Perhaps not surprisingly, parent company Wendy’s sold its majority share Of struggling Arby’s.

- Sears and their famous catalogue once dominated Canadian and U.S. retailing, but the failure to cultivate customers among newer generations and prices that are higher than those of rivals have severely wounded the company and its profitability.

- The Source used to be Radio Shack, owned by Circuit City. The Source is now owned by Bell Canada, which purchased it from bankrupt parent U.S. retailer Circuit City Stores in 2009.

- Kmart’s “Blue Light Specials” that alerted shoppers to a deeply discounted item reflect the firm’s long-running effort to be a cost leader. Kmart’s ongoing financial difficulties resulted in its 112 Canadian stores to be sold to competitor Zellers of the Hudson’s Bay Company. Those Zellers stores were either closed or converted to Target stores in 2013.

Media Attributions

- Figure 5.23: Attribution information for all included images is in the chapter conclusion.

- Can’t please everyone2 © Walter Crane is licensed under a Public Domain license

- BlockbusterMoncton © Stu Pendousmat

A situation in which a business-level strategy does not offer features that are unique enough to convince customers to buy its offerings and its prices are too high to compete effectively on based on price.