Chapter 4: Managing Firm Resources

Resource-Based Theory

Learning Objectives

- Define the four characteristics of resources that lead to sustained competitive advantage as articulated by the resource-based theory of the firm.

- Understand the difference between resources and capabilities.

- Be able to explain the difference between tangible and intangible resources.

- Know the elements of the marketing mix.

Four Characteristics of Strategic Resources

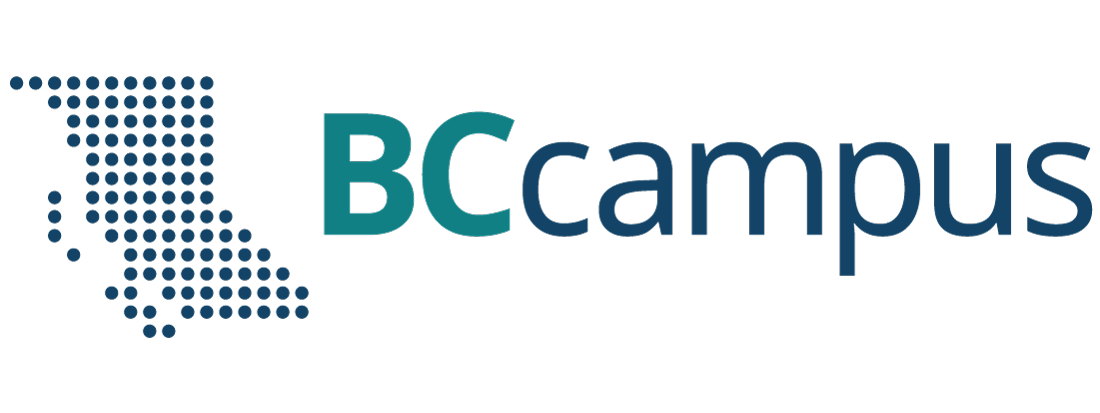

Southwest Airlines provides an illustration of resource-based theory in action. Resource-based theory contends that the possession of strategic resources provides an organization with a golden opportunity to develop competitive advantages over its rivals (Figure 4.2 “Resource-Based Theory: The Basics”) (Barney, 1991). These competitive advantages in turn can help the organization enjoy strong profits, especially over time.

Resource-based theory can be confusing because the term resources is used in many different ways within everyday common language. It is important to distinguish strategic resources from other resources. To most individuals, cash is an important resource. Tangible goods such as one’s car and home are also vital resources. When analyzing organizations, however, common resources such as cash and vehicles are not considered to be strategic resources. Resources such as cash and vehicles are valuable, of course, but an organization’s competitors can readily acquire them. Thus an organization cannot hope to create an enduring competitive advantage around common resources.

A strategic resource is an asset that is valuable, rare, difficult to imitate, and nonsubstitutable. Apple has many strategic resources, including their proprietary software and hardware platforms, which have evolved from numerous innovations and improvements over literally decades; the Apple store; many aspects of the overall buying experience including price; and a culture of innovation. It didn’t hurt to have Steve Jobs, a charismatic, innovative thinker, as their CEO for many years. Many computer companies have struggled to make money with razor-thin profit margins. Apple, using a different business model focused on their strategic resources, has succeeded with years of record profits. At one time, based on stocks, Apple was the most valuable company in the world.

Strategic resources that are valuable or rare are valuable simply due to the relatively high cost of acquiring them (e.g., an airplane) or scarcity (e.g., diamonds).

Competitors have a hard time replicating resources that are difficult to imitate. Certain resources can be and are protected by various legal means, including trademarks, patents, and copyrights, which ensures they are difficult for the competition to imitate. Other resources are hard to copy because they evolve over time and reflect unique aspects of the firm. Southwest’s culture arose from its very humble beginnings. The airline had so little money that at times, it had to temporarily “borrow” luggage carts from other airlines and put magnets with the Southwest logo on top of the rivals’ logo. While in theory, other airlines could replicate Southwest’s culture, Southwest’s “rags to riches” story evolved across several decades. Unless the airline is brand new and with no existing culture, it takes a lot of time and continuous effort to create a Southwest or WestJet culture.

A resource is nonsubstitutable when competitors cannot find alternative ways to gain the benefits that a resource provides. A key benefit of Southwest’s culture is that it leads employees to treat customers well, which in turn creates loyalty to Southwest among passengers. Executives at other airlines would love to attract the customer loyalty that Southwest enjoys, but they have yet to find ways to inspire the kind of customer service that the Southwest culture encourages.

Ideally, a firm will have a culture, like Southwest’s or WestJet’s cultures, that embrace the four qualities shown in Figure 4.2 “Resource-Based Theory: The Basics.” If so, these resources can provide not only a competitive advantage but also a sustained competitive advantage—one that will endure over time and help the firm stay successful far into the future. Resources that do not have all four qualities can still be very useful, but they are unlikely to provide long-term advantages. A resource that is valuable and rare but that can be imitated, for example, might provide an edge in the short term, but competitors can overcome such an advantage eventually.

Resource-based theory also stresses the merit of an old saying: The whole is greater than the sum of its parts. Specifically, it is also important to recognize that overall strategic resources are often created by taking several strategies and resources that each could be copied and bundling them together in a way that is difficult to duplicate. For example, WestJet’s culture is complemented by approaches that individually could be copied—the airline’s reliance on one type of plane and its unique system for passenger boarding (in bigger centers, WestJet loads passengers through both front and rear airplane doors, reducing turnaround time)—to create a unique business model whose performance is without peer in the Canadian industry.

On occasion, events in the environment can turn a common resource into a strategic resource. Consider, for example, a very generic commodity: water. Humans simply cannot live without water, so water has inherent value. Also, water cannot be imitated (at least not on a large scale), and no other substance can substitute for the life-sustaining properties of water. Despite having three of the four properties of strategic resources, water in North America has remained cheap. Yet this may be changing. Major cities in hot climates are confronted by dramatically shrinking water supplies. As water becomes more and more rare, landowners in water-rich areas stand to benefit. Twenty percent of the world’s freshwater lies in the Great Lakes. It is not hard to imagine a day when companies make profits by sending giant trucks filled with water south and west or even by building water pipelines to service arid regions.

From Resources to Capabilities

The tangibility of a firm’s resources is an important consideration within resource-based theory. Tangible resources are resources that can be readily seen, touched, and quantified, such as physical assets, property, plant, equipment, and cash. In contrast, intangible resources are resources that are difficult to see, touch, or quantify, such as the knowledge and skills of employees, a firm’s reputation, and a firm’s culture. In comparing the two types of resources, intangible resources are more likely to meet the criteria for strategic resources (i.e., valuable, rare, difficult to imitate, and nonsubstitutable) than are tangible resources. Executives who wish to achieve long-term competitive advantages should therefore place a premium on trying to nurture and develop their firms’ intangible resources.

Capabilities are what the organization can do based on the resources it possesses, another key concept within resource-based theory. A good and easy-to-remember way to distinguish resources and capabilities is this: resources refer to what an organization owns, capabilities refer to what the organization can do (Figure 4.4 “Resources and Capabilities”). Capabilities tend to arise or expand over time as a firm takes actions that build on its strategic resources. Southwest Airlines and WestJet, for example, have developed the capability of providing excellent customer service by building on their strong organizational cultures. Capabilities are important in part because they are how organizations capture the potential value that resources offer. Customers do not simply send money to an organization because it owns strategic resources. Instead, capabilities are needed to bundle, manage, and otherwise exploit resources in a manner that provides value added to customers and creates advantages over competitors.

Some firms develop a dynamic capability, the unique ability to improve, update, or create new capabilities, especially in reaction to changes in its environment. Said differently, a firm that enjoys a dynamic capability is skilled at continually adjusting its array of capabilities to keep pace with changes in its environment. Google, for example, buys and sells firms to maintain its market leadership over time, and is highly ranked as the most attractive place to work. Apple has an uncanny knack for building new brands and products as the personal technology market evolves. Not surprisingly, both of these firms ranked among the top thirteen among the World’s Most Admired Companies for 2013.

Strategy at the Movies

Pirates of the Caribbean Series

Pirates of the Caribbean is a popular franchise produced by the Walt Disney Company, with four movies on the market and a fifth to be made. Johnny Depp plays the swashbuckling hero who imaginatively gets himself in and out of trouble during the course of the ninety-minute sagas.

Pirates of the Caribbean was actually based on a ride at Disney’s theme parks. Before its release, the movie was advertised on Disney-owned media companies, such as ABC. Johnny Depp, the lead actor, was interviewed on ABC news and The View, an ABC daily daytime talk show (Lee, 2013).

Synergy is an aspect that many companies use to promote their products, often without the public knowing it. Synergy occurs when a conglomerates’ subsidiaries promote a product owned by the company itself. Disney is one of the first to incorporate synergy. Disney’s major theme parks are all used as large-scale advertising tools. The park uses the characters from the movies to promote the parks, and uses the parks to promote the movies.

Disney has been buying other companies, particularly media companies, which has opened the doors to new synergistic opportunities. The popular Pirates of the Caribbean movies have generated spinoff products to become an enormous moneymaker. Licensed products from the movie franchise include collectibles, toys, clothes and accessories, movies, and games. By 2011, the Pirates of the Caribbean franchise had brought in $1.6 billion in global merchandise retail sales (Szalai, 2011).

Disney owns several media subsidiaries, including Pixar, so that synergy enables Disney to dominate the box office. Pixar’s teaming with Disney is a very successful pairing, with over fifteen full feature animated films. The following list shows the top ten grossing movies worldwide as a result of Disney and Pixar’s collaboration (Box Office Mojo, 2014):

| Movie | Worldwide Revenue | Release Date | |

|---|---|---|---|

|

10 |

WALL-E | $223,808,164 | 2008 |

|

9 |

Brave |

$237,283,207 |

2012 |

|

8 |

Cars |

$244,082,982 |

2006 |

|

7 |

Toy Story 2 |

$245,852,179 |

1999 |

|

6 |

Monsters, Inc. |

$255,873,250 |

2001 |

|

5 |

The Incredibles |

$261,441,092 |

2004 |

|

4 |

Monsters University |

$268,492,764 |

2013 |

|

3 |

Up |

$293,004,164 |

2009 |

|

2 |

Finding Nemo |

$339,714,978 |

2003 |

|

1 |

Toy Story 3 |

$415,004,880 |

2010 |

Is Resource-Based Theory Old News?

Resource-based theory has evolved in more recent years to better explain how strategic resources and capabilities allow firms to enjoy excellent performance over time. But more than one wry observer has wondered aloud, “Is resource-based theory just old wine in a new bottle?” This is a question worth considering because the role of resources in shaping success and failure has been discussed for centuries.

Aesop was a Greek storyteller who lived approximately 2,500 years ago. Aesop is known in particular for having created a series of fables—stories that appear on the surface to be simply children’s tales but offer deep lessons for everyone. One of Aesop’s fables focuses on an ass (donkey) and some grasshoppers. When the ass tries to duplicate the sweet singing of the grasshoppers by copying their diet, he soon dies of starvation. Attempting to replicate the grasshoppers’ unique singing capability proved to be a fatal mistake. The fable illustrates a central point of resource-based theory: it is the right combination of resources and capabilities that fuels enduring success, not any one resource alone.

In a far more recent example, sociologist Philip Selznick developed the concept of distinctive competence through a series of books in the 1940s and 1950s (Selznick, 1957). A distinctive competence is a set of activities that an organization performs especially well. WestJet and Southwest Airlines, for example, appear to have distinctive competencies in operations, as evidenced by how quickly they move flights in and out of airports. Further, Selznick suggested that possessing a distinctive competency creates a competitive advantage for a firm. Certainly, there is plenty of overlap between the concept of distinctive competency, on the one hand, and capabilities, on the other.

So is resource-based theory in fact old wine in a new bottle? Not really. Resource-based theory builds on past ideas about resources, but it represents a big improvement on past ideas in at least two ways. First, resource-based theory offers a more complete framework for analyzing organizations, not just snippets of valuable wisdom like Aesop and Selznick provided. Second, the ideas offered by resource-based theory have been tested and refined through scores of research studies involving thousands of organizations. In other words, there is solid evidence backing it up.

The Marketing Mix

Leveraging resources and capabilities to create desirable products and services is important, but customers must still be convinced to purchase these goods and services. The marketing mix—also known as the four Ps of marketing—provides important insights into how to make this happen.

One early master of the marketing mix was circus impresario P. T. Barnum, who is famous in part for his claim that “there’s a sucker born every minute.” The real purpose of the marketing mix is not to trick customers but rather to provide a strong alignment among the four Ps (product, price, place, and promotion) to offer customers a coherent and persuasive message (Figure 4.6 “The Marketing Mix”).

A firm’s product is what it sells to customers. WestJet sells, of course, airplane flights. The airline tries to set its flights apart from those of other airlines by making flying fun. This can include, for example, flight attendants offering preflight instructions in rap or humorously, as seen on YouTube videos. The price of a good or service should provide a good match with the value offered. Throughout its history, WestJet has usually charged lower airfares than its rivals, typically forcing other competitors to match WestJet’s price. Place can refer to a physical purchase point as well as a distribution channel. Southwest has generally operated in cities that are not served by many airlines, and WestJet often uses secondary airports in major cities. This has allowed the firm to get favorable lease rates at airports and has helped it create customer loyalty among passengers who are thankful to have increased competition in air travel.

Finally, promotion consists of the communications used to market a product, including advertising, public relations, and other forms of direct and indirect selling. Southwest is known for its clever advertising. In a television advertising campaign, for example, Southwest lampooned the baggage fees charged by most other airlines while highlighting its more customer-friendly approach to checked luggage. Given the consistent theme of providing a good value plus an element of fun to passengers that is developed across the elements of the marketing mix, it is no surprise that Southwest and WestJet have been so successful within a very challenging industry.

Key Takeaways

- Resource-based theory suggests that resources that are valuable, rare, difficult to imitate, and nonsubstitutable best position a firm for long-term success. These strategic resources can provide the foundation to develop firm capabilities that can lead to superior performance over time. Capabilities are needed to bundle, manage, and otherwise exploit resources in a manner that provides value added to customers and creates advantages over competitors.

Exercises

- Does your favourite restaurant have the four qualities of resources that lead to success as articulated by resource-based theory?

- If you were hired by your college or university to market your athletic department, what element of the marketing mix would you focus on first and why?

- What other classic stories or fables could be applied to discuss the importance of firm resources and superior performance?

References

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Box Office Mojo. (2014). Pixar Total Grosses. Retrieved from http://www.boxofficemojo.com/franchises/chart/?view=main&id=pixar.htm&sort=gross&order=ASC&p=.htm

Chi, T. (1994). Trading in strategic resources: Necessary conditions, transaction cost problems, and choice of exchange structure. Strategic Management Journal, 15(4), 271–290.

Lee, A. (2013). Disney and Pixar – Synergy Strategies. Retrieved from http://alexyllee.wordpress.com/2013/02/21/disney-and-pixar-synergy-strategies/

Selznick, P. (1949). TVA and the grass roots. Berkeley, CA: University of California Press.

Selznick, P. (1952). The organizational weapon. New York, NY: McGraw-Hill.

Selznick, P. (1957). Leadership in administration. New York: Harper

Shaughnessy, H. (2013). Apple Remains World’s Most Admired Company, Followed by Google and Amazon. Retrieved from http://www.forbes.com/sites/haydnshaughnessy/2013/02/28/apple-remains-worlds-most-admired-followed-by-google-and-amazon/

Szalai, G. (2011). Disney: ‘Pirates of the Caribbean’ Merchandise Has Made $1.6B in Sales. Retrieved from http://www.hollywoodreporter.com/news/disney-pirates-caribbean-merchandise-16b-95393

Image descriptions

Figure 4.2 image description: Resource-Based Theory: The Basics

According to resource-based theory, organizations that own “strategic resources” have important competitive advantages over organizations that do not. Some resources, such as cash and trucks, are not considered to be strategic resources because an organization’s competitors can readily acquire them. Instead, a resource is strategic to the extent that it is valuable, rare, difficult to imitate, and nonsubstitutable.

- VALUABLE resources aid in improving the organization’s effectiveness and efficiency while neutralizing the opportunities and threats of competitors. Although the airline industry is extremely competitive, WestJet Airlines is one of the most profitable airlines in North America. One key reason is that WestJet flies a modern fleet of fuel-efficient Boeing Next-Generation 737 Aircraft.

- DIFFICULT-TO-IMITATE resources often involve legally protected intellectual property such as trademarks, patents, or copyrights. Other difficult-to-imitate resources, such a brand names, usually need time to develop fully.WestJet’s culture arose from the beginnings of the company. WestJet was inducted into the corporate culture hall of fame after being named one of Canada’s Most Admired Corporate Cultures for several consecutive years.

- RARE resources are those held by few or no other competitor

WestJet’s culture provides the firm with uniquely strong employee relations in an industry where strikes, layoffs, and poor morale are common. Westjet’s vision is that of consistently and continuously providing an amazing guest experience. - NONSUBSTITUTABLE resources exist when the resource combination of other firms cannot duplicate the strategy provided by the resource bundle of a particular firm.

The influence of Westjet’s organizational culture extends to how customers are treated by employees. Approximately 85 per cent of eligible WestJet employees owns shares in the company through the employee share purchase plan.

Important Points to Remember

- Resources such as WestJet’s culture that reflect all four qualities valuable, rare, difficult to imitate, and nonsubstitutable — are ideal because they can create sustained competitive advantages. A resource that has three or less of the qualities can provide an edge in the Short term, but competitors can overcome such an advantage eventually.

- Often together multiple resources and Strategies (that may not be unique in and of themselves) to create uniquely powerful combinations. Westjet’s culture is complemented by approaches that individually could be copied—the airline’s emphasis on direct flights, its reliance on one type of plane, and its unique system for passenger boarding—in order to create a unique business model in which effectiveness and efficiency is the envy of competitors.

- Satisfying only one or two Of the valuable, rare difficult to imitate, nonsubstitutable criteria will likely only lead to competitive parity or a temporary advantage.

Figure 4.4 image description: Resources and Capabilities

Resources and capabilities are the basic building blocks that organizations use to create strategies. These two building blocks are tightly linked—capabilities tend to arise from using resources over time.

Resources can be divided into two main types:

- Tangible resources are resources that can be readily seen, touched, and quantified. Physical assets such as a firm’s property, plant, and equipment are considered to be tangible resources, as is cash.

- Intangible resources are quite difficult to see, touch, or quantify. Intangible resources include, for example, the knowledge and skills of employees, a firm’s reputation, and a firm’s culture. WestJet was inducted into the corporate culture hall of fame after being named one of Canada’s Most Admired Corporate Cultures.

While resources refer to what an organization owns, capabilities refer to what the organization can do. More specifically, capabilities refer to the firm’s ability to bundle, manage, or otherwise exploit resources in a manner that provides value added and, hopefully, advantage over competitors.

- A dynamic capability exists when a firm is skilled at continually updating its array of capabilities to keep pace with changes in its environment, Scotiabank bought a majority stake in a Chilean retailer’s credit card business to round out its portfolio. Fortis Inc. announced the purchase of Texas-based UNS Energy Corp. These moves help the companies evolve in chosen directions.

Figure 4.6 image description: The Marketing Mix

Much like a baker mixes together ingredients to create a delicious cake, executives need to blend together various ways to appeal to customers. As one of the most famous business “recipes,” the marketing mix suggests four factors that need to work together in order for a firm to achieve superior performance. The four Ps of the marketing mix are illustrated below using Duff Goldman’s custom cake shop, Charm City Cakes.

- A firm’s product is what it sell to customers. The unique cakes offered by Duff have included replicas of Radio City Music Hall and the Hubble space telescope.

- The price of a good or service should provide a good match with the value offered. While a grocery store’s cake might sell for $30 or less, the uniqueness of Duff’s cakes allows him to charge upwards of $1 ,000 per cake.

- Place can refer to a physical purchase point as well as a distribution channel. The location of Charm City Cakes is itself unique – a converted church. This adds to the hip image Duff tries to project.

- Promotion consists of the communications used to market a product, including advertising, public relations, and other forms of direct and indirect selling. Duff’s popular show on The Food Network, Ace of Cakes, spread Duff’s fame and extended the reach of his cake shop dramatically.

Media Attributions

- RAF-YYC (3865758102) © RAF-YYC is licensed under a CC BY-SA (Attribution ShareAlike) license

- Westjet-Westjet 737 approaching Las Vegas (2412776016) © Frank Kovalchek is licensed under a CC BY (Attribution) license

- Figure 4.4: Attribution information for all included images is in the chapter conclusion.

- Figure 4.6: Attribution information for all included images is in the chapter conclusion.

- Barnum & Bailey clowns and geese2 © The Strobridge Litho. Co., Cincinnati & New York is licensed under a Public Domain license

A theory that contends that the possession of strategic resources can provide an organization with competitive advantages over its rivals.

Resources that cannot be easily duplicated by competitors and are often protected by various legal means, including trademarks, patents, and copyrights.

Resources that exist when competitors cannot find alternative ways to gain the benefits that a resource provides.

A competitive advantage that will endure over time.

Resources that can be readily seen, touched, and quantified, such as physical assets, property, plant, equipment, and cash.

Resources that are difficult to see, touch, or quantify, such as the knowledge and skills of employees, a firm’s reputation, and a firm’s culture.

The unique ability to improve, update, or create new capabilities, especially in reaction to changes in its environment.

A set of activities that an organization performs especially well.

The four Ps (product, price, place, and promotion) that firms use to offer customers a coherent and persuasive message.

Goods and services a firm sells to customers.

The amount firms charge for their goods or services.

A physical purchase point as well as a distribution channel.

The communications used to market a product, including advertising, public relations, and other forms of direct and indirect selling.