Chapter 12 Financial Aid and Funding Options

12.2 Personal Budget

There are many different ways of paying for educational expenses. When creating your own financial plan for school, you may wish to consider:

- Working to save for tuition and expenses before attending.

- Working during summer months to pay for your school semester.

- Working part-time and attending school part-time.

- Cutting down on living expenses by living with family or in student housing.

- Applying for grants, bursaries, or scholarships.

- Requesting support from family.

- Applying for student loans.

Exercise: Financial Aid

Talk to someone from the financial aid office at your school of choice. The people in this office may suggest other options for funding that you are not aware of.

Jot down some notes after talking with the financial aid people. You may need these notes for your Budget assignment (coming soon!).

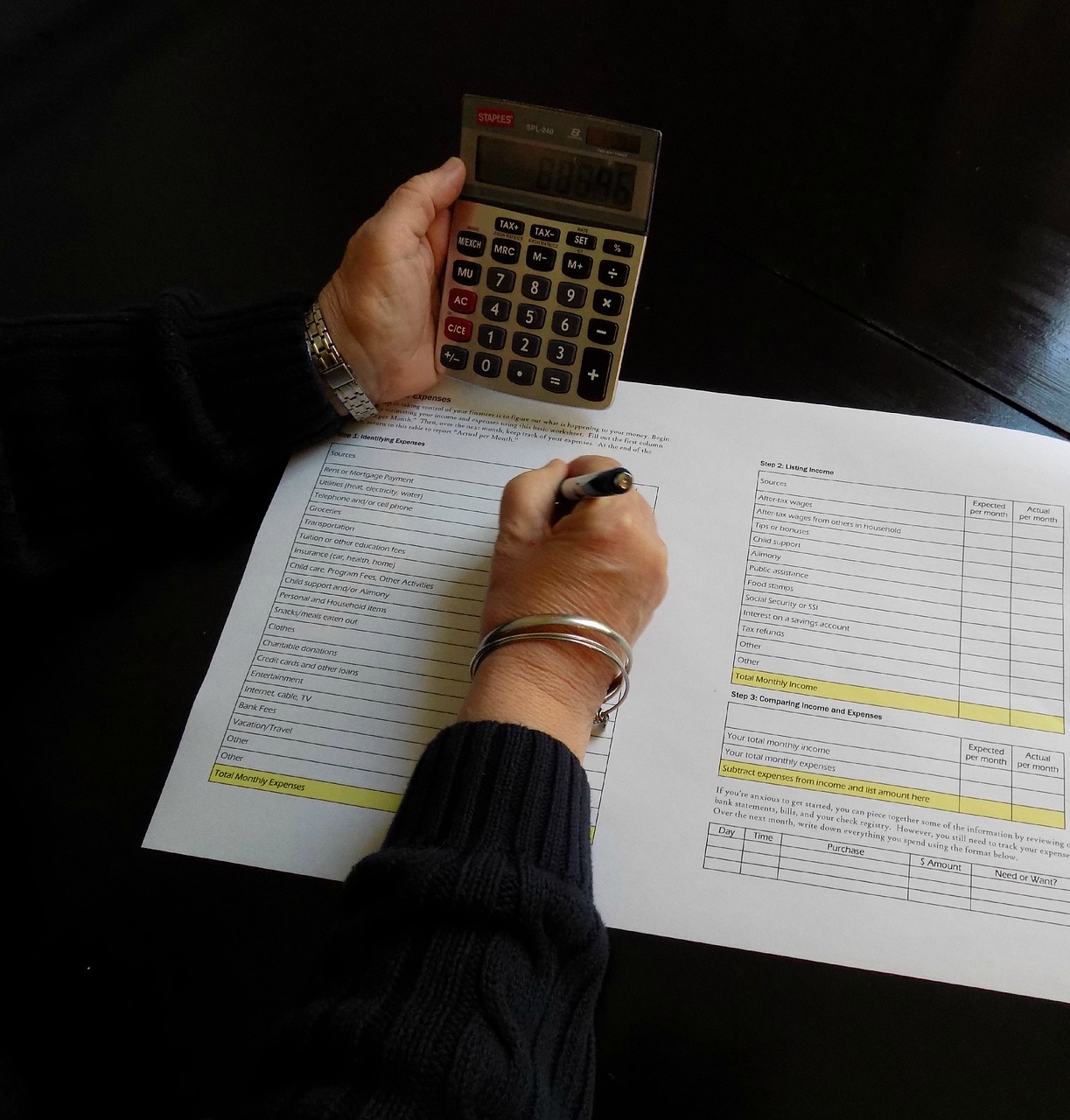

Making a Budget

A budget is a document that tracks the money you have coming in including sources of income, and the money you have going out to pay for your expenses. For students, a budget helps them plan for future school expenses, keeping in mind all sources of income, including student loans, grants and earnings from part-time work or full-time summer jobs.

When returning to school, most people have to really think about their needs versus their wants:

| Needs | Wants |

|---|---|

|

|

You may have to let go of some wants when you return to school. Can you think of some wants you could eliminate from your budget while you are a student? How about making coffee instead of buying coffee? Buying less clothing? Going out to movies less often and staying home to watch one instead? You may find it is easier to eliminate some expenses that are wants rather than needs.

Exercise: Saving Money

List as many ways as you can that you can cut back on expenses in your own personal life. Make sure they are practical and doable. For example, it may not be practical to save money on a bus pass if the alternative is walking to school one and a half hours each way. This will help your fitness level but may seriously cut into your study time, so it is likely not worth the savings. Likely you will think of many practical areas you can save money though.

Also remember that budgets get adjusted regularly, so you’ll have to review your budget often. Add income that may come in, such as bursaries or income tax returns, to keep your budget accurate.

Exercise: Prepare a Simple Budget

Using your word processor program, prepare a simple budget showing how you would pay for 1 year of your program at a post-secondary institution. The easiest way to start is to break down your monthly expenses and add the costs associated with school. You will have to estimate expenses for many items (e.g. food, hydro)

Be sure to include your costs for:

- Accommodation – rent, mortgage, or student residence (example: $800 per month times 12 months)

- Hydro (example: $85 per month times 12 months)

- Food

- Personal care items

- Childcare (if necessary)

- Transportation (remember: your fees at many post-secondary institutions in BC include a bus pass)

- Books

- Tuition and student fees

- Phone and internet services

- Any other special expenses you can think of

Also include a detailed list of where your funding might come from. Be sure to include:

- Money you have saved

- Education savings plans (e.g. RESP’s)

- Income from a part-time job

- Tax returns and credits

- Gifts/loans from family and friends

- Student loans (use the information you gathered from talking with financial aid offices at your institution)

- Scholarships, bursaries, etc. (use the information you gathered from talking with financial aid offices at your institution)

Personal Budgeting

Personal budgeting sounds like a boring and constricting thing to do. In reality, it is enlightening and empowering. The truth is that most people don’t know where their money goes every month. They seem surprised when it runs out. But it should never be a surprise. The amount of money coming in needs to be greater than the amount of money going out. Otherwise, you’ll end up running out, or going into debt. It’s particularly frustrating when you can’t afford to do something which was really important to you, because you inadvertently spent money on something that really wasn’t that important to you.

Creating a personal budget means being intentional and proactive about where you spend your money. Budgeting is creating a plan to make sure it goes where you want it to go – no surprises. Tracking your spending will help you be aware of the realities of what you spend your money on. This is particularly important for a couple. Money is the biggest thing that causes conflict in a marital relationship. Often couples tend to think it’s the other person who is out of control on their spending. It can be eye-opening to track spending and see where you yourself are spending more than you thought. A personal budget is a finance plan which allocates future income towards expenses, savings and debt repayment. Personal budgeting requires both creating a doable plan and following it.

Different Ways to Budget

There are several ways to create a personal budget, and you need to choose a way that works for you. Some divide up their cash into marked envelopes designated for different categories (rent, food, cell phone, car, entertainment, etc.) and some track it digitally using a spreadsheet. What most people find is that if they do it for a good length of time (such as a year), they change their spending habits enough that they don’t have to track so carefully anymore.

Of course, as income changes, habits change, and money issues creep in again. It’s a funny thing. You’d think that when you start making more money, it would be much easier to balance your budget every month, but in reality, as wages increase so do expectations and expenses. It’s a good idea to redo your personal budget as required.

Once you get started with a personal budget, first building it, and then sticking to it, you will realize it’s easier than you think.

Exercise: Compare Budget Templates

Explore a couple of different ways to create a budget. Here are some examples:

- TD Excel Worksheet: Personal Budget Spreadsheet – TD Canada Trust [Excel]

- Spreadsheet123 Online Personal Budget. You will want to ignore the ads (don’t click on them) and you can ignore the survey it asks you to do (click on “skip survey”).

For both of these examples: Make sure to click on enable editing once you have downloaded the file. Then you will be able to insert your own figures into the chart. The nice thing about these online tools is that they do all the math for you.

You may explore a different budget template that you are familiar with or that someone recommended to you. Some people prefer to use good ol’ pencil and paper and make their own charts. Think about which templates or models will work well for you. You will use one in the assignment below.

Once you work out your budget, you will be able to see how much discretionary money (the money left over after all the necessary payments come out) you should have at the end of the month. Then you can decide how much of it will be for savings, for charity, for a special purchase, or for a special holiday.

However you decide to do it, your budget should reflect your spending. Notice that most pre-made charts have a place for other. It’s important to identify the other items that are unique to you. Think of your habits (good and bad). If you buy a case of beer every week, or a pack of cigarettes every day, or go skiing every Saturday, make sure you put these in your budget as well. You may need to adjust the amount once you evaluate whether or not you can afford these.

Assignment: Develop a Detailed Monthly Budget

Use the simple budget you developed above. You should be able to use the information you gathered there to complete this more detailed budget exercise. For this exercise:

- Reflecting on the “To do” activity above, think about the different ways to keep track of a budget.

- Choose one of the above methods or find one that you like better. Alternatively, you can create your own budget sheet.

- Make a personal monthly budget. Fill it in and take inventory: calculate how much you spend and how much you make. Record any debts, and any savings plans. If you are in debt, include debt repayment in your budget with a timeline when your debt will be paid off. If you have any special things you are saving for, identify these along with the cost, the monthly savings, and when you will be able to afford to purchase the item or when your savings goal will be met for items such as attending post-secondary.

- Now make a personal plan identifying strategies you will use to be able to stick to your budget. Choose ones that you think will work for you. What changes will you make in your spending practices?

Your assignment will consist of the monthly budget sheet along with a short paragraph discussing changes required. If you are using an online tool to create your budget sheet, print it to have a hard copy and save it one your own computer. If you are using pen and paper, make copies of your budget to use as working copies each month.

Financial Planning

Making a budget and following it is the first step. Budgeting will help you get control of your spending and be more aware of where your money is going. As well as using a budget to manage your current finances and short-term goals, it is important to plan for future needs.

For example: do you plan to have a family and purchase a home? Do you plan to attend post-secondary full time? Do you want to save for your children’s post-secondary education? Will you need a new car in a few years, or have to do a major renovation to your home? If you don’t plan ahead, these things likely won’t happen. Financial planning for the future often just involves identifying those things that are important to you, and then building it into the plan. Putting a little bit every month into a savings plan can add up quickly, and it will be there for the things that matter to you. Once you determine a reasonable amount to set aside each month, it’s good to make sure it’s done automatically. You can set up your finances so that payments automatically go into:

- Savings accounts at your bank.

- Investments such as GICs, mutual funds, stocks and bonds.

- Education savings such as RESPs.

- Retirement savings such as RRSPs.

Depending on your circumstances, this may seem impossible. Sometimes there just isn’t enough at the end of the month to have anything extra. After analyzing your income and expenses, it may cause you to realize more changes need to be made. Do you need to get a different job that pays more? Do you need to get an additional part-time job to supplement your income? Can you find ways to do things more inexpensively (spend less, find cost savings, change habits?) Do you need to sell something that is draining your finances? You will need to come up with a plan that will at least allow you to balance your budget each month. Whether your budget is to prepare for post-secondary school (save money so that you can go in the future) or to attend now (budget so that you can stretch your money throughout the school year), using these principles will help you achieve your goals.

Text Attributions

This chapter is a remix of the following resources:

- “Module 1, Unit 2: The Decision Making Process – Section 9 Financial Planning for School” in the Education and Career Planning Open Course by Allison Schubert. Adapted by Mary Shier. CC BY.

- “Module 4 Living Skills Section 2 Money Management” in the Education and Career Planning Open Course by Mary Shier. CC BY.

Media Attributions

- Calculator © brandnewday, pixabay is licensed under a Public Domain license